All we want to close and native people were alive and well, but sooner or later, there comes a time when we have to move on to the status of heirs. May inherit a variety of properties, money and valuables, often part of the inheritance becomes the vehicle.

To legalize the ownership of the vehicle inherited by the heir or heirs - if more than one, will require an appeal to the notary office to open the case for membership in the inheritance. inheritance procedure is not as simple as it might seem at first glance, it would require a certain loss of time, cost, and most importantly - knowledge of civics.

It makes sense to consider in more detail the procedure of registration of inheritance rights to the car and found that entry into legacy will enable to get free of the right to own and complete disposal of the vehicle, without the payment of taxes.

Content

- When, how soon can enter into the inheritance of the law

- For what reasons can extend the entry deadline inherited

- That the law makes the inheritance, if the heirs do not come in the right of inheritance

- If the heirs to the car a few people how to divide the inheritance

- How and who appreciates the car inherited

- Evaluation of motor vehicles without the expert, the pros and cons

- Evaluation of professional experts, the pros and cons

- Stamp duty on the car's legacy, how do you know the amount of state duty

- How to join the legacy of a car according to the law, what documents are needed

- Tips for professionalists: how to speed up and make a car inheritance correctly

When, at what period, you can enter into inheritance by law

In accordance with the Civil Code of the Russian Federation, sufficient grounds for entry into inheritance can be:

will

law

There are also two possible ways to implement the procedure:

- through the court

- through a notarized office

According to the law, the death day of the testator automatically becomes the day of the opening of the inheritance. If it happened so that a person disappeared or the exact date of his death is unknown, then the date of entry into force of the court decision is established as the date, according to which this person is declared deceased.

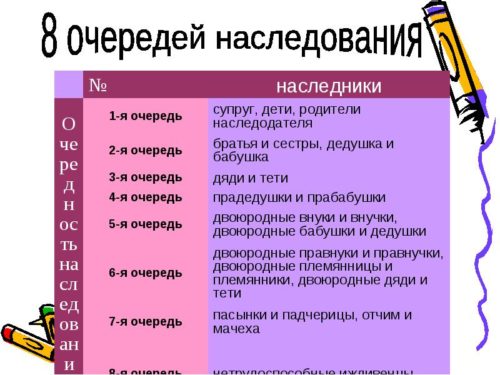

The transition of inherited property is carried out in accordance with the will, if it is available, or in accordance with the law, which is valid for this period of time. The law provides for the division of property, including the car between the most close relatives, if there is no, the order of distribution will be determined by the queue for inheritance consisting of more distant relatives.

Ultimately, property should find its new owner. If the heirs of any degree of kinship will not be discovered, or they wish to completely abandon the receipt of inheritance, then all the property will be transferred to the state. By law, each of the heirs has the right to refuse its share in favor of another heir.

A very important point - inheritance is considered open since the death of the testator. The appeal period of heirs about the entry intoheritance is limited strictly and is exactly 6 months.

We recommend: Before starting the procedure for obtaining inheritance - make sure that the car is not secured or arrest, the ability to prohibit the third parties can significantly complicate the design process.

For what reasons you can extend the deadline for inheritance

There are valid reasons that do not allow the heir to make timely entry into the possession of inheritance. In this case, the appeal to court instances will be required. It should be noted that despite a strictly agreed period of 6 months, if there is evidence and relevant documents, it is still possible to correct the situation with missed deadlines.

To restore your right to receive the inheritance, the heir will need to contact the judicial authorities with a statement in which it will be necessary to specify the reasons for which this situation arose:

- Finding on inpatient treatment and health status is so serious that the doctor's hospital to leave the territory is categorically banned, such a reason must be confirmed by the certificate from the attending physician, in writing and certified by the seal.

- A fairly valid reason will be the military service, including urgent, if you leave the territory of the military unit only at a certain time. As an acquittal document, a certificate of the military registration and enlistment office is required that the inheritance applicant passed military service at the time of entry into the inheritance.

- A significant argument with judicial review will be a statement about living abroad. Of course, if documents are attached to the application, confirming the fact that a person for good reason could not leave the limits of the country of residence.

The right to receive the inheritance will be restored and in the event that the heir just did not report the death of the testator, because often members of one family live and work on different continents, an option is possible that there was not a person who did not find a person who will tell all relatives about this sad event. Naturally, a candidate for an inheritance in this case is not guilty.

In case the heirs can somewhat be the option, when another person will be added to their list of limitations to their list. But provided that the inheritance was drawn up by law and no one from the list of heirs would not object to such a turn of events. Contact the court in this case will not be required, you can restore the period by contacting the notary.

It should be remembered that the law limits the period for the restoration of the right to six months.

What the law is done with inheritance if the heirs did not enter the right of inheritance

If it happens that the deceased person does not have any relatives and the testament in favor of any other citizens, he did not leave, then in accordance with the law, property will be transferred to the state.

Proven to the state ownership of the property of the deceased and in the event that none of the relatives will turn to the notary on the entry into the inheritance for 6 months from the date of opening the inheritance.

But the legislation provides special conditions that allow you to announce at a later time to the heirs to apply to the court with a statement. In the event that documents will be attached to the application, which the Court considers important, the decision on the transition of property to state ownership may be revised.

If the heirs on the car are several people how to share inheritance

Among the inherited property, not only real estate, jewelry or money are often found, cars are often becoming the subject of inheritance. If the heir is one - there is no questions, he gets into the undivided use of the car, whether on the will, or by law. He can manage the vehicle at its discretion.

An important point - to enter the car in the will its current owner will be able only if the surname of the testator is indicated in all documents.

If the car was acquired by the general power of attorney, then in the event of the death of his real owner, the official owner will be considered the official owner of the car. By law, the car must be returned to him, relatives will not have the right to its inheritance. All hope that the former owner of the transport is a decent man and voluntarily give the car to the relatives of the deceased.

If the heirs are somewhat, then the right to own the car will be divided between them. They will have to agree on how they will go with the car - will be passed to someone from the heirs under certain conditions, or they will put it on sale. The agreement between the heirs is best to issue officially, at the notary.

If you come to a single opinion, the heirs cannot - need to appeal to courts that are required to highlight the shares of the object and determine the property right.

How and who appreciates the car inheritance

The car's inheritance will require the provision of some documents that will become basic to open the inheritance, namely:

- statements of heir

- certificate of death owner auto

- expanding documents (insurance, registration documents, contracts, TCP)

- testaments, if it is available

- documents on the degree of kinship, on them will be determined by the size of the duty

- estimated documents

It makes sense to consider the last item in more detail.

Regarding the procedure for assessing the car, you can contact a private firm that must have a license to provide this service.

After surveying, the specialist will make an act indicating the market value of the car, and the assessment is made at prices that were relevant at the time of the death of the owner.

This is a very important factor, in the future it will have an impact on the amount of state duty, which will be required to be paid when issuing a certificate, he will also serve as a basis for further taxation.

After contacting the expert organization and the conclusion of the contract, the date and time of the auto assessment is specified.

The check itself is:

- in the inspection of the car

- identifying defects and damage and fixing them

- definition of run

- warning assessment in% ratio

Without receipt of an appraisal document, the notary has no right to issue a property certificate. The assessment is made in the presence of the heir, in the estimated document there must be a signature as a specialist appraiser and the heir. The latter is given the right to specify your comments in the document if they are.

To date, car evaluation is made in several ways:

- revenue

- cost

- comparative

In the Help, the appraiser should indicate its conclusions according to these methods of assessment. The certificate should also indicate the average value of a similar car on the market.

When evaluated, take into account:

- age of car

- mileage

- in what condition is the body and block, providing traffic

- availability of navigator, autorentor, alarm system

- formation of the model in the market

- the reasons why the commodity value is reduced, as well as the average cost.

Several photos are attached to the document, regulatory acts that served as the basis for the assessment of property.

Evaluation Act - a document issued in writing, with compulsory signatures of a specialist of the company and the leader, with seals. Be sure to make several copies of the document and assure them.

To make an assessment of the cost of the car will need 3 days from the moment of appeal to the firm engaged in expert activities. The term may increase if there are no important documents or controversial issues.

The result of the work of the expert bureau must accommodate the report with the print, stitched and numbered.

Rating a car without an expert, pros and cons

You should add a few clarifications about the conduct of the examination. According to Art. №135-FZ for evaluation does not necessarily provide a car.

From the documents will be required to provide:

- passport for vehicle

- document certifying the identity of the application submitter

- document confirming the death of the former owner of the car

- car mileage information

Appraisal documents addressed to the heir.

The estimated cost does not include the costs of repairs and vehicle inspections. The car is rated exclusively at the date of death of the testator, at a market value.

Information about the date of purchase of a car is not required.

As a lack of correspondence assessment, it can be noted that the estimated value determines which there will later be the size of the duty, i.e. "Correspondence" size of the duty may be prohibitively large, because to identify the defects available from a particular car from the expert will not be possible.

Assessment by professional experts, pros and cons

Undoubtedly, even the most experienced expert will not be easy to evaluate the vehicle without having seen him. Those. In any case, the average cost in the market of similar transport will be given. In fact, with a thorough examination of the car, defects may be detected, including hidden, imperceptible to the naked eye.

It is this factor that can influence the estimated value, and at the same time on the size of the duty that will be required to pay inheritance.

When evaluating the car, the expert will indicate the cost within the market thresholds. From the expert depends on what a threshold to stick to, even if it is accuracy to follow technical regulations, then you can make a decision more profitable to the client, or the state that will receive a duty.

Heir recommended:

- contact an expert with explanation of the purpose of the examination

- ask him about specifying the minimum permissible value

- make sure that the document indicates exactly the region where expertise was carried out, it must comply with the region of opening the inheritance.

The results of the examination produced in other regions may be unacceptable for this locality and cause discord among heirs.

Helpful advice. To find out more information about organizations with the right to evaluate the vehicle in the official document, writing from the Ministry of Finance No. 03-05-06-03 / 97.

The selection of the appraiser The heir should do independently, the notary cannot control this question.

State duty on the inheritance of the car, how to find out the amount of state duty

The percentage of state tax for heirs who are not close relatives, and took place in close relationship with the testator different. If kinship with the testator were close, it takes 0.3% of the appraised value of the car. The law limits the amount of duty of 100 thousand rubles.

For heirs who are not close relatives of the duty will be twice as much, ie, 0.6%. the total amount of duties in such a case, 1 million rubles will be limited.

Since the amount of duty may be unaffordable for the heirs, the law provides for the possibility of deferred payment (according to Art. 90 of the Civil Code).

If the fee payment shall be made in installments, it will not accrue interest (according to Art. 333.41 n. 2 Revenue Code). An extension may be granted no more than 3 years.

The reasons for deferment can be:

- difficult financial situation

- the risk of going bankrupt with simultaneous payment of the entire amount

- force majeure circumstances

How to join the legacy of a car according to the law, what documents are needed

If the will was not written in a timely manner, then the heir will have to enter into an inheritance according to the law, the rules in this case will be the same for all types of inherited property.

The first action of the heir: an appeal to the notary at the place of residence of the testator, submission of an application which will indicate that you agree to take all due to you wealth.

To visit a notary is required to prepare a package of documents confirming:

- the death of a person who was the owner of the car, with the necessary date specified therein care of the testator, it will be the date of opening of the inheritance

- that the vehicle was registered in the traffic police

also require vehicle registration document - the presence of loved ones (or not) of kinship with the deceased (this can be a passport or birth certificate,

- proof of guardianship, etc.), marriage certificate,

- estimated vehicle documents

- fAQ about the place of residence of the deceased

- receipt confirming payment of the registration fee.

If the heir is a minor person, the registration of his share of the inheritance are obliged to deal with the child's parents, or people who took care of him.

Profyuristov tips: how to accelerate and properly arrange car inherited

The process of registration of the property obtained into the inheritance, including the car, lasts half a year. For a car, this term is considerable - firstly during this period its market value (if you are going to sell cars) can fall by a few%, secondly (if you previously used the machine by proxy) you will lose a reliable means of movement for as many as 6 months. Both situations for the heir are undesirable.

Naturally, the question arises how to speed up the procedure. Let us turn to Article 1163 of the Civil Code of the Russian Federation, it indicates:

- get the right to possession of inherited property Citizens receive after 6 months from the date of the opening of the inheritance

- the reduction of the 6-month term is possible only if it is documented that other heirs, except those that appealed for the issuance of a certificate of ownership (or its part)

- accordingly, the court decision, the process of issuing a certificate of inheritance may suspend in the event of a confirmation of the existence that has not yet born heir.

A more reliable and simple version of obtaining the possibility of using a car without waiting for 6 months is the design of domestic.

Of course, the elderly relatives must seize the desire for writing it in advance. The conclusion of the contract of donation is carried out in writing and fixed by the notary.

If we talk about the design of the inherited car, then after receiving the certificate of the right to inheritance, you can:

- without registering the car in the traffic police - to sell or give another person

- repair cars on yourself

Renewaling the car should be implemented within 10 days after receiving the document on inheritance, which should be applied to the traffic police department, regardless of the place of residence and registration.

It will be necessary to prevent the acting policy of the CTP, it is possible to buy it after passing and getting a diagnostic card.

Renewal of the car is carried out upon presentation of the following documents:

- statements of the new owner

- his passports

- PTS

- certificate of registration of TS

- certificate of inheritance

- insurance Policy Osago

- document confirming the payment of state duty

It is recommended to prepare the photocopies of all documents in advance.

A little to reduce the cost of expenses will allow the car registration on the public services portal.

Another pleasant moment: since 2006, hereditary tax for the recipients of the inheritance is canceled.

Related Materials

- How to find out the owner of the car by the number of his car, check the car by the number of the traffic police machine, check the car by the state number of the car for free

- LED backlight of the car, the backlight of the bottom of the car, the backlight of the legs in the car, the backlight in the door of the car, the backlight of the car is fine

- Steering rail rail, knock of steering rack, reasons for the knock and repair of the steering rack do it yourself

- How to open a car without a key. Lost the key from the car what to do, the key from the car inside the car

- Overtaking a car when you can start overtaking a car, rules of traffic rules

- Tachometer on auto, tachometer does not work, causes a tachometer breakdown, make repair with your own hands

- Medical examination for driver's license 2019

- Gestures and light signals drivers

- Autolaspa: LED, halogen, ice lamps How to pick up lamps in the car

- Passage of technical inspection in 2017, detailed instructions

- Changes in OSAO since September 2017, detailed information

- Spike sign: sizes of the spike sign, setting the spike sign in accordance with traffic rules

- How to issue a new body, documents for the new body in the traffic police, new law July 2017 on car registration in traffic police

- Buy tint for car, best toning for car

- Auto barrard cars what is the auto barrard and how it works

- Buying a used car that you need to know buying a used car, useful tips

- How to find out the traffic police fines by last name, how to find out the traffic police fines on the car number, how to find out the fines online

- Blocked the departure, what to do if they blocked the departure

- International driver's license 2017, how to get useful tips

- Car rental cars, what a service and how to act, useful tips

- Travel by car in Europe, which documents are required for travel

- Driver's categories how to decrypt 2017 driver's license categories

- Best Registrar 2017, Criteria Selection of High-quality Registrar, Top 10 Popular Recorders 2016-2017

- 50% discount on the traffic police penalty how to use a discount

- How to check the ban on the registration of a car, how to remove the ban on car registration

- Fines 2017 for the lack of rights from the driver

- Special marks of the driver's license, how to decipher the special marks of the 2017 driver's license and an old sample certificate

- How to remove the abandoned car in the yard to complain how to clean the yards from the rubble, how to evacuate the abandoned car

- Bumper kenguryatnik, whether or cannot be installed kenguryatniki in Russia

- Punishment for the transfer of the steering wheel: for the transfer of the steering wheel without right, for the transfer of the steering wheel to a drunk driver, for the transfer of the steering wheel a minor

- Bribe to a traffic police officer, what a punishment by law is waiting for an employee of the traffic police taking and how they will punish the driver of the giving bribe

- Duplicate Gos Rooms on a car where you can get a duplicate of the state number by law

- Broken roads of Russia, which regulates the law on the quality of roads 2017

- What insurance to contact after an accident by law

- Europrotokol 2017, how to issue a protocol without a traffic police

- If, due to the poor-quality road surface, the car has been damaged, as and from whom to get compensation for the repair of the car in 2017, which states the law

- How to pay for paid parking, payment methods for parking from a mobile phone, payment of parking card, in a parking lot, on SMS, via the Internet, who are laigned in charge parking

- Car tinting 2017 by law, which is possible, and what can not

- OSAGO electronic how to issue an electronic policy of OSAGO, the peculiarities of the purchase of OSAGO via the Internet

- How to buy an electronic policy of CCOS 2017, step-by-step instruction

Comments