Automobile insurance of civil liability has long been a standard for car owners. Reimbursement of damage caused to the car or man requires huge cash costs. The insurance policy of the OSAO helps shifting financial problems from the car owner to the insurance company. Acquisition of an electronic policy is a relatively new service, according to which any driver can arrange a policy in online mode, directly through the insurer's website. About this further in the article.

Content

- Independent Calculator OSAGO, the price covered by legislation

- Buy policy cheap, it's good or bad

- Insurance offers to buy a policy cheap, what is the trick, why it is a beneficial insurance company

- Why the policy acquired cheaper than provided by law will be valid for the traffic police, but in the case of an accident due to the driver's fault, the policy will not act

- Why, when imprisoning, it is necessary to give loyal information

- How insurance companies will receive information about the driver from January 2017

- How to issue an electronic policy of OSAGO (step-by-step instruction)

- How to get the official policy of OSAGO on a green blank

- How to work sites of insurance companies, operation mode

- How to find and order a good laptop at an affordable price with free shipping

Independent Calculator OSAGO, the price covered by legislation

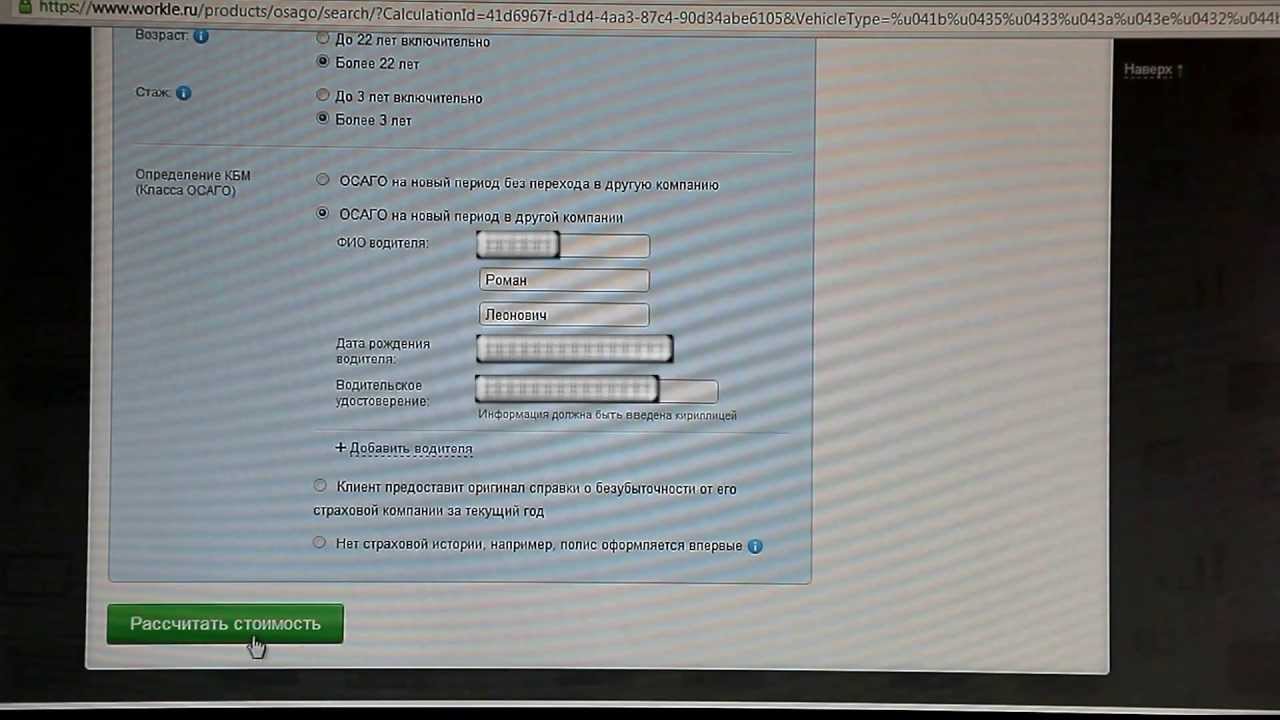

Before purchasing an electronic policy via the Internet, it is desirable to use an independent calculator to calculate the cost. Its action is based on the same calculations that are conducted by the managers of insurance companies. Of course, the base rate is established at the state level, but the corrective coefficients are slightly different. The car owner should know that there are a number of factors that significantly increase future payment, in particular - the use of a vehicle mainly in large cities, the presence of other drivers admitted to the car driving, driver's experience less than a year and so on. Among the most significant moments are the engine power and emergency situations for previous periods.

Buy policy cheap, it's good or bad

When making an electronic policy should be very attentive. Buying insurance is necessary at the cost, which is provided for by law. If the cost of the policy in a particular insurance company does not correspond to the cost you calculated by you on an independent calculator, you need to be alerted, especially if the insurance company offers to purchase a policy cheaper. The problem is that when purchasing cheap insurance due to errors in the information provided, the policy will practically be invalid.

Insurance offers to buy a policy cheap, what is the trick, why it is a beneficial insurance company

In fact, such a policy will act and it will be possible to present the police inspections when checking the documents, that is, it will not entail a penalty for the lack of insurance. But, in the event of an accident that occurred due to the driver's fault, it will be presented with regressive requirements, that is, to reimburse the damage to the affected party will have to the driver itself. With an accident, the insurance policy acquired cheaper will not be valid.

It is possible that in practice some of the insurance companies will deliberately sell policies cheaper, allowing in error coefficients. It will be quite profitable for them, because they will receive money for insurance, and no damage do not have to compensate.

Why the policy acquired cheaper than provided by law will be valid for the traffic police, but in the case of an accident due to the driver's fault, the policy will not act

Let us consider in more detail what will happen in the event of an accident, the perpetrator of which acquired an electronic policy at the low cost:

If, when concluding an obligatory insurance contract in electronic form, the insured has provided unreliable information, which entailed a unreasonable decrease in the size of the insurance premium, the insurance company has the right to present regressive requirements in the amount of insurance indemnity to the insured, which provided unreliable data in the conditions of an insured event, And in the prescribed manner, to recover from it, cash is unreasonably saved as a result of providing unreliable information, regardless of the occurrence of the insured event.

Thus, in the event of a crash driver:

- From your pocket will pay the repair of a damaged car.

- Pay the insurer the missing part from the cost of the insurance policy.

At the same time, the insurer who sells policies is cheaper, absolutely nothing risks.

Why, when imprisoning, it is necessary to give loyal information

Naturally, it is categorically impossible to provide incorrect information insurer. If the auto owner deliberately provide an insurance company incorrect data than to reduce the cost of the policy, the insurer will be able to present regressive requirements in relation to the insured.

How insurance companies will receive information about the driver from January 2017

From 01/01/2017, insurers will have the possibility of a special way to obtain information about drivers:

4. By agreement of both parties, the policyholder has the right to provide copies of the documents required for registration of the compulsory insurance contract. In situations that are provided for by the mandatory insurance rules, these documents may be provided in the form of electronic documents or electronic copies or by obtaining insurance companies with access to the data contained in the documents specified in the sub-clauses "B" - "E" of the paragraph of this article, through Sharing information in electronic form with relevant organizations and bodies, in particular using a unified electronic interdepartmental interaction system.

How to issue an electronic policy of OSAGO (step-by-step instruction)

To obtain an electronic version of the CTP:

- Go to the insurer's website providing this service.

- Enter all the information on the vehicle, the owner and drivers.

- Pay for the amount of insurance using online payments.

- The insurance policy comes to the email of the insurer. It can be printed, but not necessarily.

How to get the official policy of OSAGO on a green blank

Previously, when purchasing an electronic policy, the driver could not get a document printed on an official forms of green (at the present moment pink) color. But since 2017, this opportunity appeared. At the request of the car owner, it can get a green / pink blank in the insurer's office or get it by mail in paper form. At the same time, getting the original in the insurer's office is free. Sending insurance by mail is paid by the insured separately.

How to work sites of insurance companies, operation mode

As for the work of the sites of insurance companies, then insurers are obliged to ensure the continuity and smoothness of the functioning of their official sites, as well as the possibility of making a policy in electronic form for everyone.

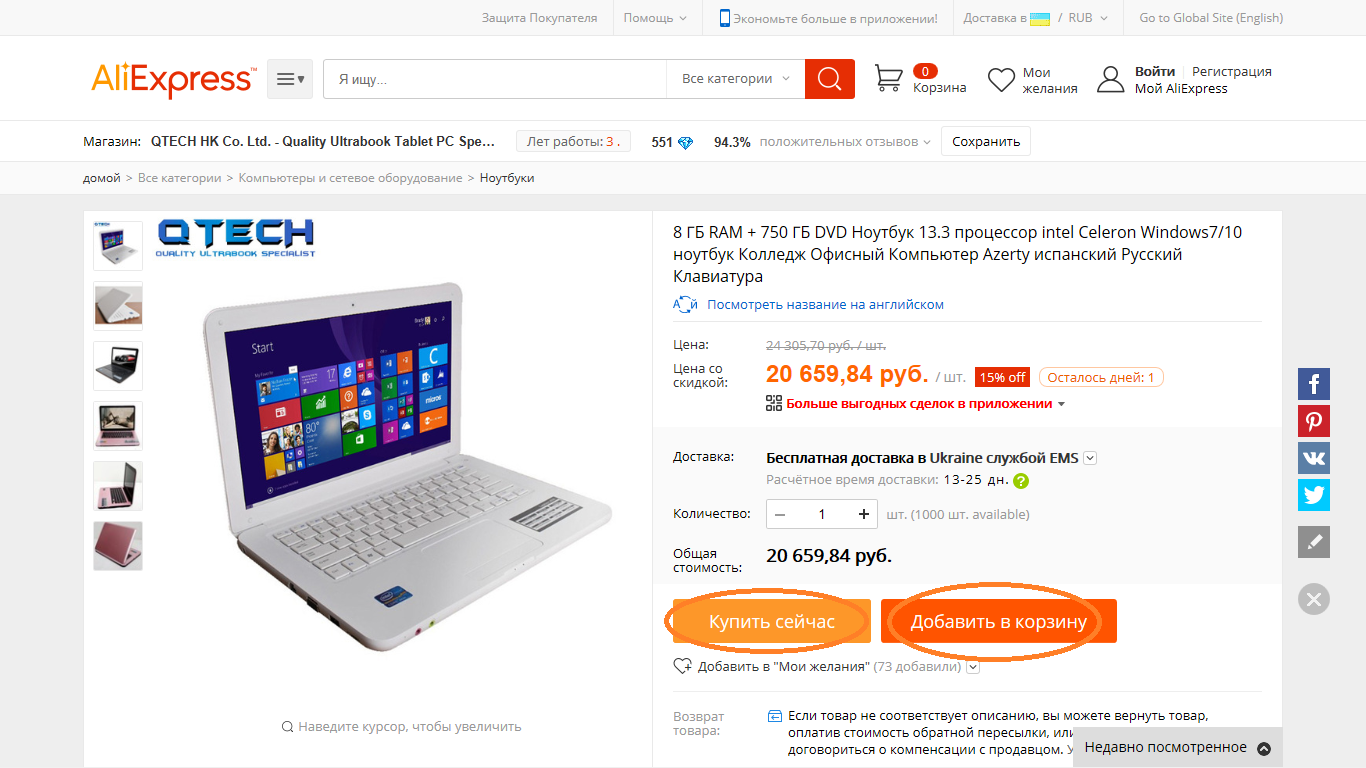

How to find and order a good laptop at an affordable price with free shipping

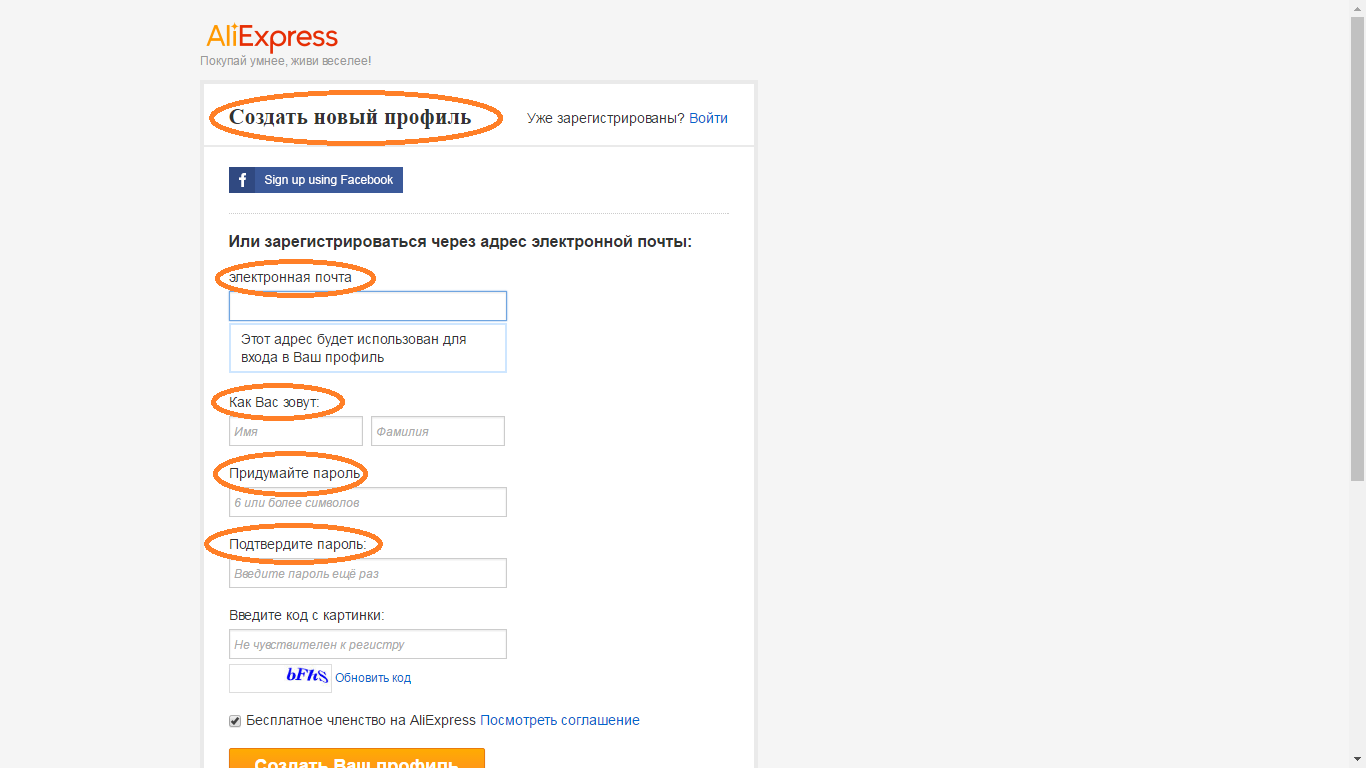

- We register on the site. To do this, you must enter your name, surname and email address, which must be confirmed within 24 hours.

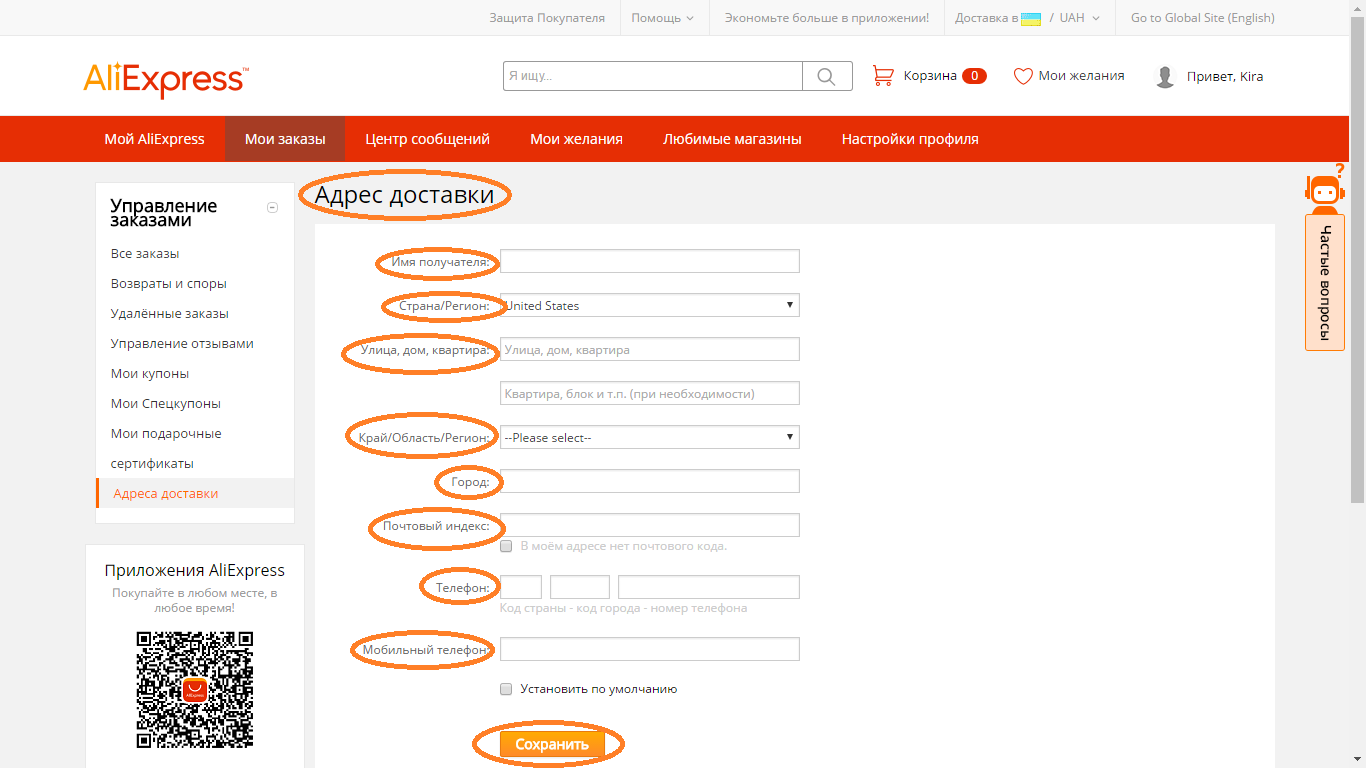

- In your profile, fill in the address of the delivery of the Latin alphabet symbols.

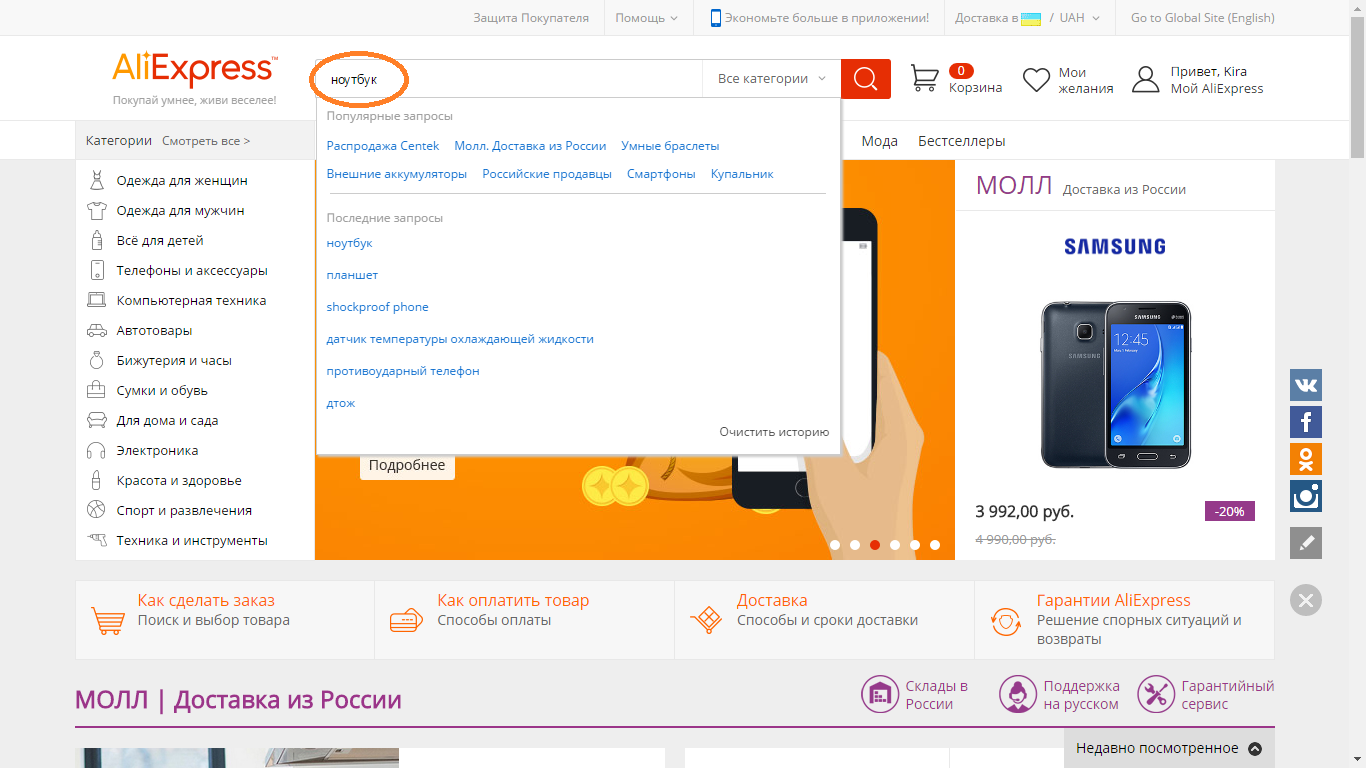

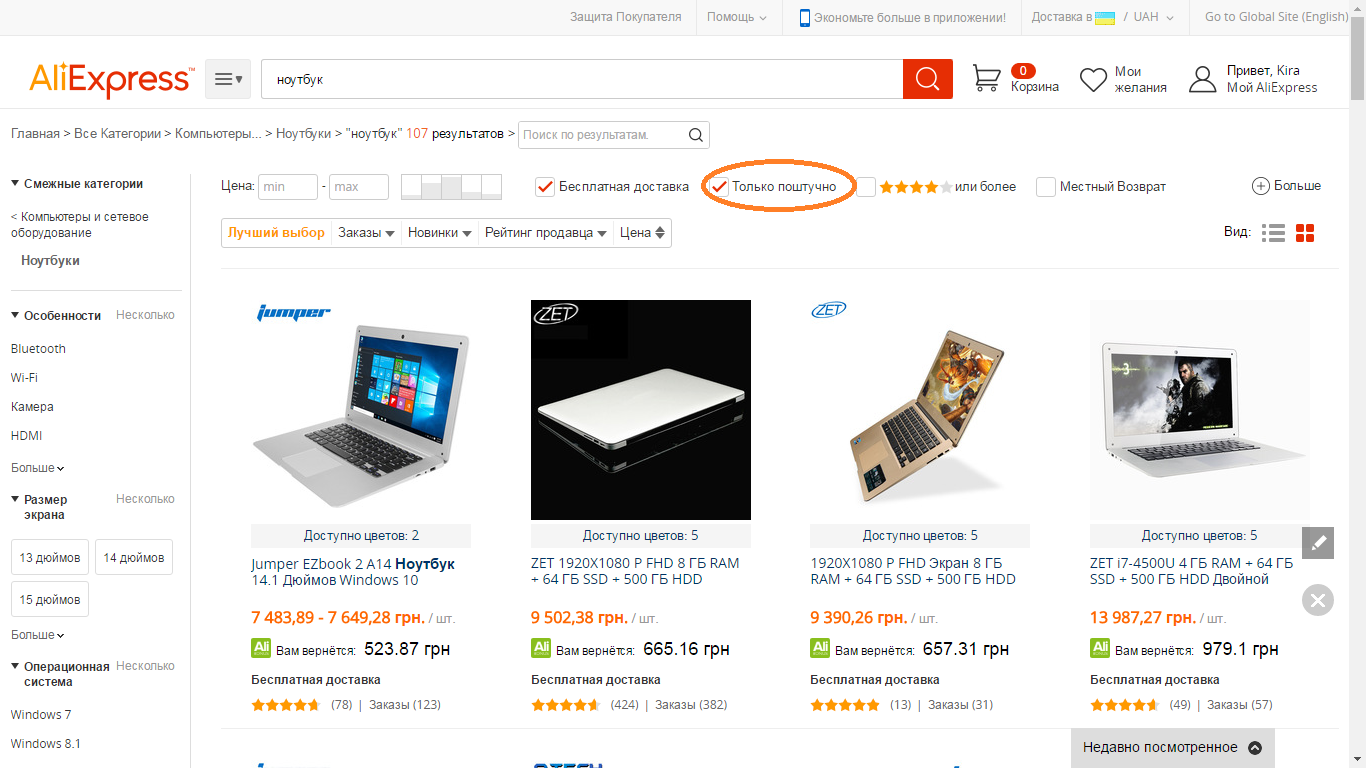

- In the search bar, we enter the name of the goods we are looking for. In this case, this is a laptop.

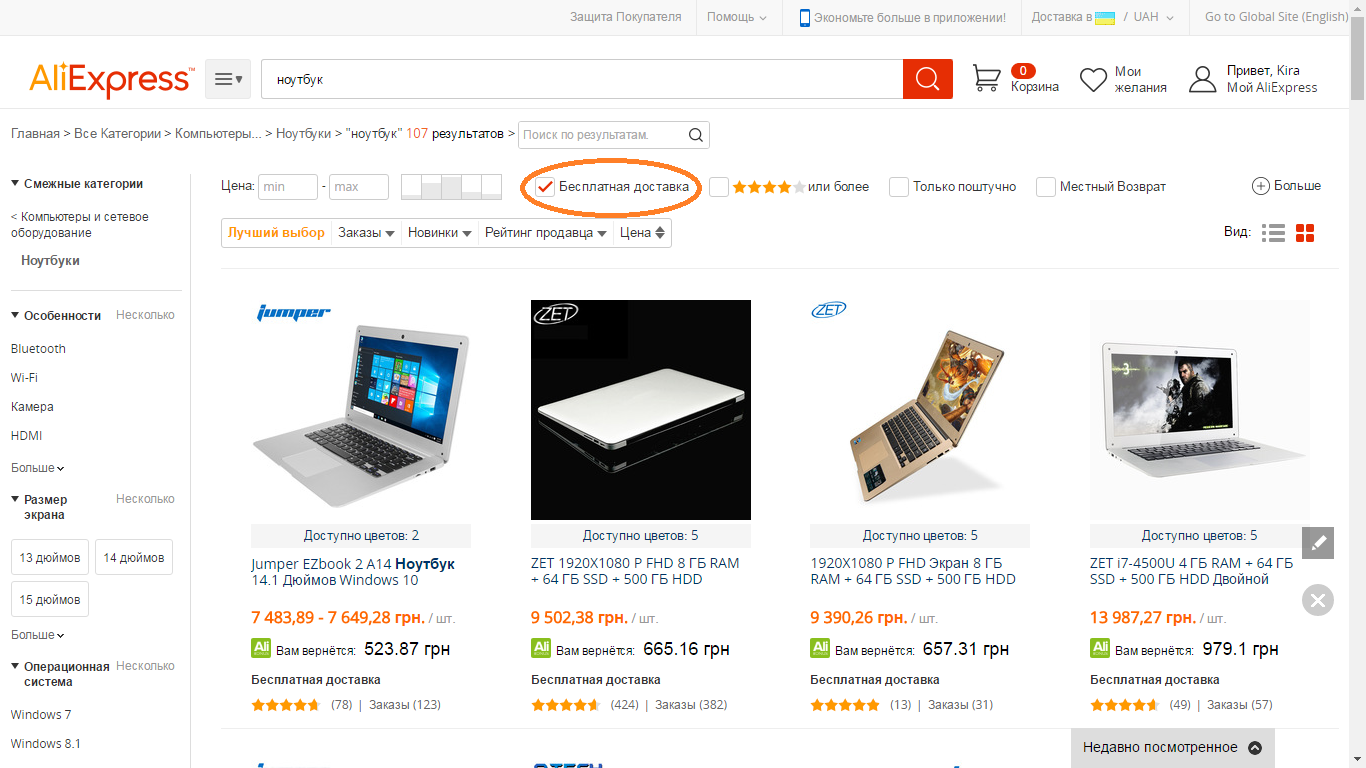

- Choose goods with free shipping.

- To cut off wholesale vendors, put a tick opposite "only the piece".

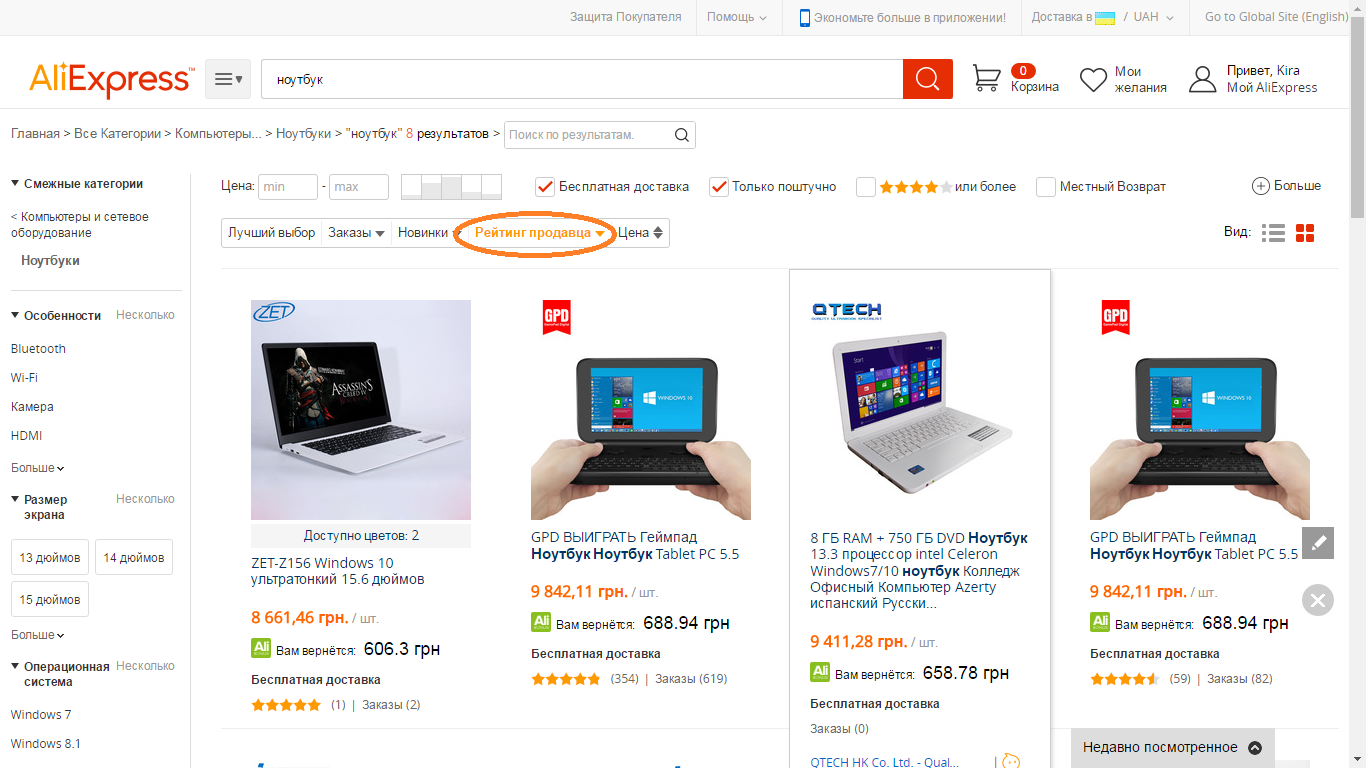

- We sort the results by the seller rating, as if the selected seller has a high rating, it means that it has a high-quality product and at an acceptable value.

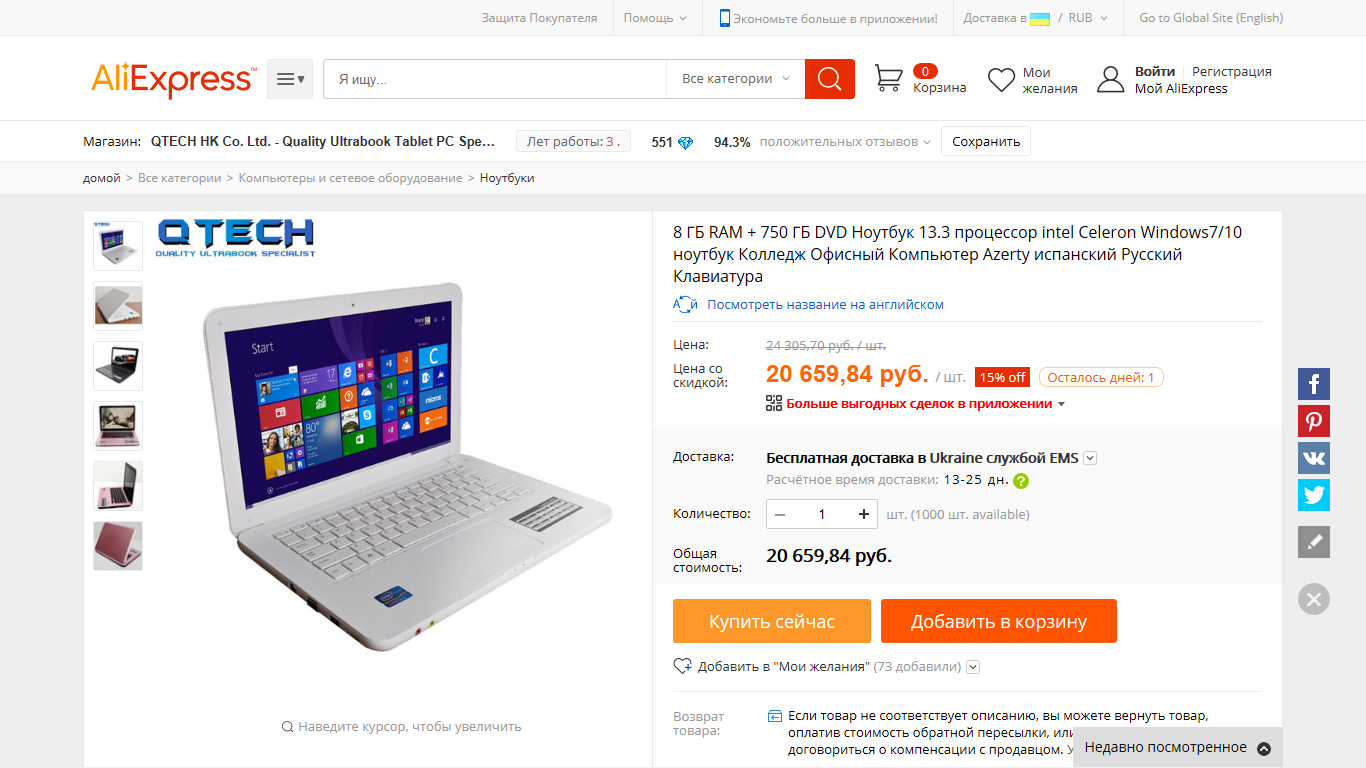

- We choose a laptop that most suits you at the price and specifications.

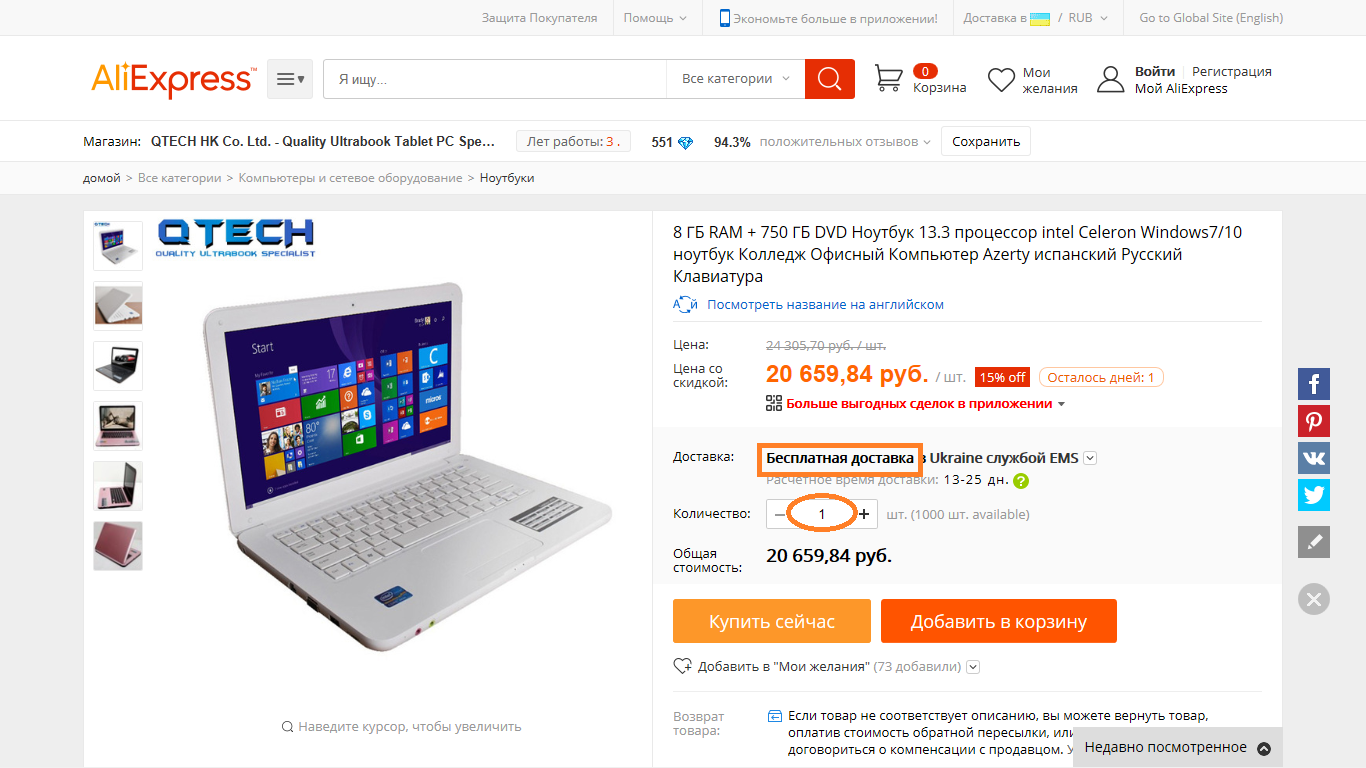

- On the product description page, choose color and quantity.

- For instant payment, click "Buy Now." To pay for the order a little later, click "Add to Cart".

Related Materials

- Stove 2110, bad warm stove 2110, VAZ 2110 heating system, repairing the heating system VAZ 2110 with their own hands

- VAZ 2114 stove blows with cold air, stove 2114, bad warm stove VAZ 2114, device and repair of heating VAZ 2114 do-it-yourself, removing the stove VAZ 2114

- How to subdominize the car. How to put a jack. Types of jacks for cars.

- VAZ 2109 Fuse Block, VAZ 2109 Fuse Block Carburetor, VAZ 2109 Fuse Block Injector, Old VAZ 2109 Fuse Block, VAZ 2109 Fuse Block, VAZ Fuse Block 2109

- Car exhaust gas catalyst, faulty catalyst, pluses and cons of the catalyst, how to change the catalyst for the planeencitel

- Stove blowing cold air VAZ 2114, badly blowing the stove VAZ 2114, why badly blowing the stove VAZ 2114

- How to find out the owner of the car by the number of his car, check the car by the number of the traffic police machine, check the car by the state number of the car for free

- How to choose Used tires, Useful Tips

- Winter car road, pressure in passenger car tires in winter, good battery for the car in winter, whether to warm the car in winter

- In winter, the car is poorly started. How to make a car in winter, do you need to warm up the car in winter, useful tips

- Economy fuel consumption machines, the most economical car consumption

- Tires brands for passenger cars, labeling of car tire labeling, residual passenger car tire protector, how to pick a tire on a car brand, car tire tread pattern

- Working transmission operation, mechanical gearbox clutch work, driving with manual gearbox, useful tips

- Rear beam Peugeot 206 sedan, rear beam device Peugeot 206. Rear beam Peugeot 206 Malfunction, repair of the rear beam Peugeot 206

- Diesel fuel in winter, additive for diesel fuel in winter, how to choose the best diesel fuel

- Diesel winter does not start. How to start diesel in winter, heating diesel in winter.

- Japanese bridgestone tires, winter studded bridgestone tires, bridgestone tires brand

- Tire marking decoding for passenger cars, labeling wheels, how to choose the right tires on the disks

- Diesel engine in winter, launch of the diesel engine in winter, what oil to fill in a diesel engine in winter, useful tips

- LED backlight of the car, the backlight of the bottom of the car, the backlight of the legs in the car, the backlight in the door of the car, the backlight of the car is fine

- Recovered tires, bus tire, restored tire protector, can I use them

- Choose winter tires, which is a winter tires, which pressure in winter tires should be marked with winter tires, how to choose the right winter tires, the best winter tires 2019

- Steering rail rail, knock of steering rack, reasons for the knock and repair of the steering rack do it yourself

- Cameless car tires, a set for repair of tubeless tires, repair of the cannon-free tire do it yourself

- Russian tires, Russian tires Winter, Russian All-season tires, Voronezh AMTEL tires, Tires "Matador Omsk Tire", Kama-tires are world-class bus

- How to open a car without a key. Lost the key from the car what to do, the key from the car inside the car

- Silent tires, quiet winter tires, quiet studded bus, which tires to choose, overview tires

- Tires and safety, safety of the bus, why it is necessary to constantly monitor car tires

- Rules of safe driving of the car in the rain and slush, safe driving of the car for beginners

- Rust converter which is better for cars, rust converters to choose how to use rust transducer, professionals

- Polishing the body of the car do it yourself, how to choose a polishing paste, useful tips

- Engine durability, engine life, how to extend engine life

- Knock in the car. Knock when moving the car. What can knock in the car. How to determine the cause of the knock.

- ABS car, what is ABS car, ABS system malfunction, ABS diagnostics

- Overtaking a car when you can start overtaking a car, rules of traffic rules

- Fuel pump VAZ 2110, VAZ 2110 gas station scheme, VAZ 2110 fuel pump device, VAZ 2110 gas station repair,

- Automotive antennas for radio, automotive antenna device, car antenna do it yourself

- Front suspension Kalina, device front suspension Kalina, knock in front suspension Kalina, repair of front suspension Kalina

- Shock absorber Oil, best oil shock absorbers, pumping oil shock absorbers, how to properly pump oil shock absorber

- Clutch malfunctions, touches clutch, causes a clutch malfunction, how to eliminate

Comments