Nobody is insured against participation in the accident, but each driver should be prepared for a similar incident. Insurers provide motorists the opportunity to solve the problem without departure of traffic police officers to the scene. For this, the participants of the accident just fill the Europrotokol and present his insurance company within the prescribed period. About this further in the article.

Content

Europrotokol what it is

The European Protocol (that is, Europrotokol) is a special notice form that allows for specific conditions to register an accident without exiting the traffic police workers. Europrotokol is provided to the Insured when executing the OSAGO policy. Under the conditions of correctly filling out the document, the insurance company undertakes to compensate the damage to the affected side within the limit on the automotive insurance policy.

The insurance contract must necessarily indicate the requirements for the insurance company in the design of the European Protocol. Another indicates the amount, deadlines and procedure for compensation for damage to the affected party. It is worth noting that if the car took part in the accident and, accordingly, the driver from another state, he must have an insurance policy called the Green Card. In such a situation, the blank-notification issued by the Russian insurer is filled. Green Card guarantees the affected side to pay insurance compensation.

The principle of interaction between car owners is quite simple: Drivers fill the drivers at an accident, record damage with a camera or a mobile phone, after which they can leave the scene. It gives car owners the opportunity to save time, since there is no need to cause traffic police workers to fix the accident. The culprit of the accident, violating the rules of the road, in this case can avoid the need to compensate for the damage to the victim, since the insurance event has come.

When Europrotokol cannot be executed

Below you can familiarize yourself with the table of the conditions for the design of Europrotokol.

| Condition | It is allowed to form eurrethocol | It is forbidden to form eurrethocol |

| Collision of cars (accident). | Only two cars participate in the accident. | Only one car participates in the accident (hitting an obstacle, skid). More than two cars participate in the accident. |

| The presence of an existing insurance policy. | For both participants in an accident with himself there is an acting policy of the CTP. | One or two accident participants do not have an operating policy of OSAGO. It is forbidden to make up eurortocol even if the policy is forgotten at home. |

| Causing damage. | Damage caused only by cars, passengers and drivers were not injured. | Damage caused to other property (cargo, luggage, road elements, fences, other structures). The harm caused by the health of the driver, passengers or pedestrians. |

| The presence of disagreements about the circumstances of the accident. | Participants of the accident reached agreement (decided who was affected, and who is the culprit). There is no disagreement. | None of the participants recognize their guilt, there are contradictions about the accident circuit, the circumstances of the incident. DTP participants misinterpretably filled out the notice. |

| The amount of damage caused by the accident. | The size of the damage does not exceed more than 50 thousand rubles. In all regions of the Russian Federation and 400 thousand rubles. in St. Petersburg, Moscow and Mo. | The size of the damage exceeds the established limit. If the European Protocol is drawn up, but the size of the damage is larger than the established limit, the missing amount is charged from the culprit of the accident. |

Europrotokol registration rules 2017

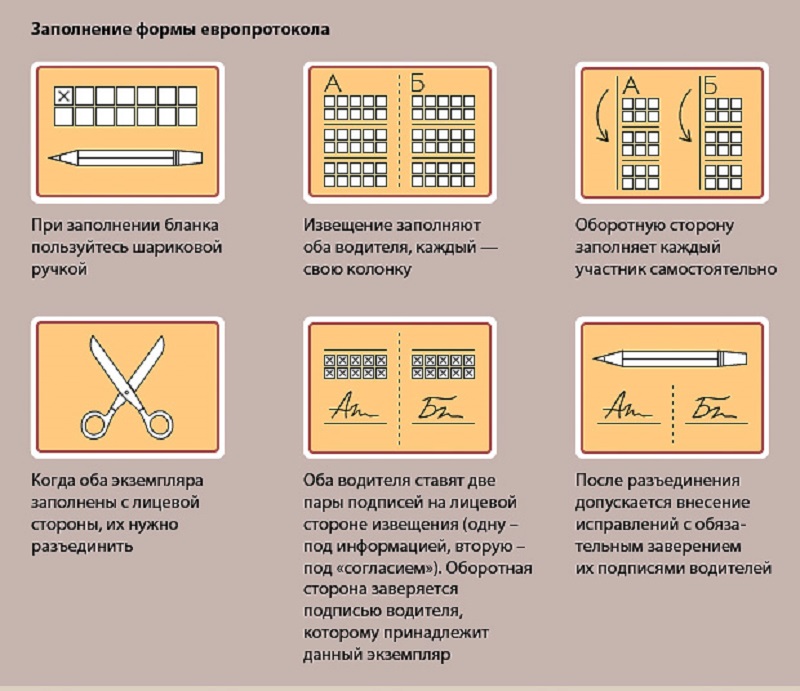

- The form you need to fill out with a simple blue ballpoint handle, not a pencil and non-gel paste. Write as picking as possible, preferably printed letters.

- At the Europropol form, the corrections are unacceptable, so it is desirable to first fill the draft version on any sheet or notepad, and only then transfer information to the document.

- If one form was spoiled, use the forms of another participant in the accident.

- If the form is not enough to display all the data, write applications on a separate paper, however, in the notice itself, you must specify that the additions are noted on a separate sheet. Also there should be both participants in the accident.

- If, after filling out the notice, edits were made, they should be certified by both participants in the accident.

- It is possible to separate the sheets of Europrotokol only after filling out all the information and signing the document with both participants in the incident.

- The insurer will not pay insurance if the protocol sheets are different. It is advisable to check the correctness of the form several times. Any error in Europrotokol is the basis for the insurance company to refuse the victim in the payment.

Policy Camera why it can be false how to check

Recently, the fake insurance policies of the CTP are increasingly discovered in the turn, and the most of them "pop up" during the accident. It is worth noting that not always the owner of the fake knows that his policy is a worthless piece of paper, the use of which can lead to criminal liability.

To the category of fictitious papers include such categories of documents:

- Flap double. Series, "Poster" to the insurance company, press, the number is all valid, but for one contract - two owners at the same time.

- Policy with changes. For example, if the end date is changed or the start of validity.

- Fake blank. This is the most real "Lipa". The number can coincide with the real number of the policy shipped to some insurance company in any region.

- Re-sold policy. At the end of its term in one region, the Polis can "emerge" in another or the same as completely clean.

- The policy of the insurance company gone from the market, issued after its exit from the OSAGO system. According to the law, such forms should be removed from the turnover, however, as practice is evidenced, they are delayed in the market for a long time.

On the eye, you can define only the first kind of fakes. All others are usually no different from the real. Moreover, half of them are real documents, simply not having a legal force. When applying real numbers with correct "assistent", even a system check on the PCA website will not help. The fake is revealed during the excitement of the payment after attentive checking the information of all sides of the accident.

Europrotokol design gradno

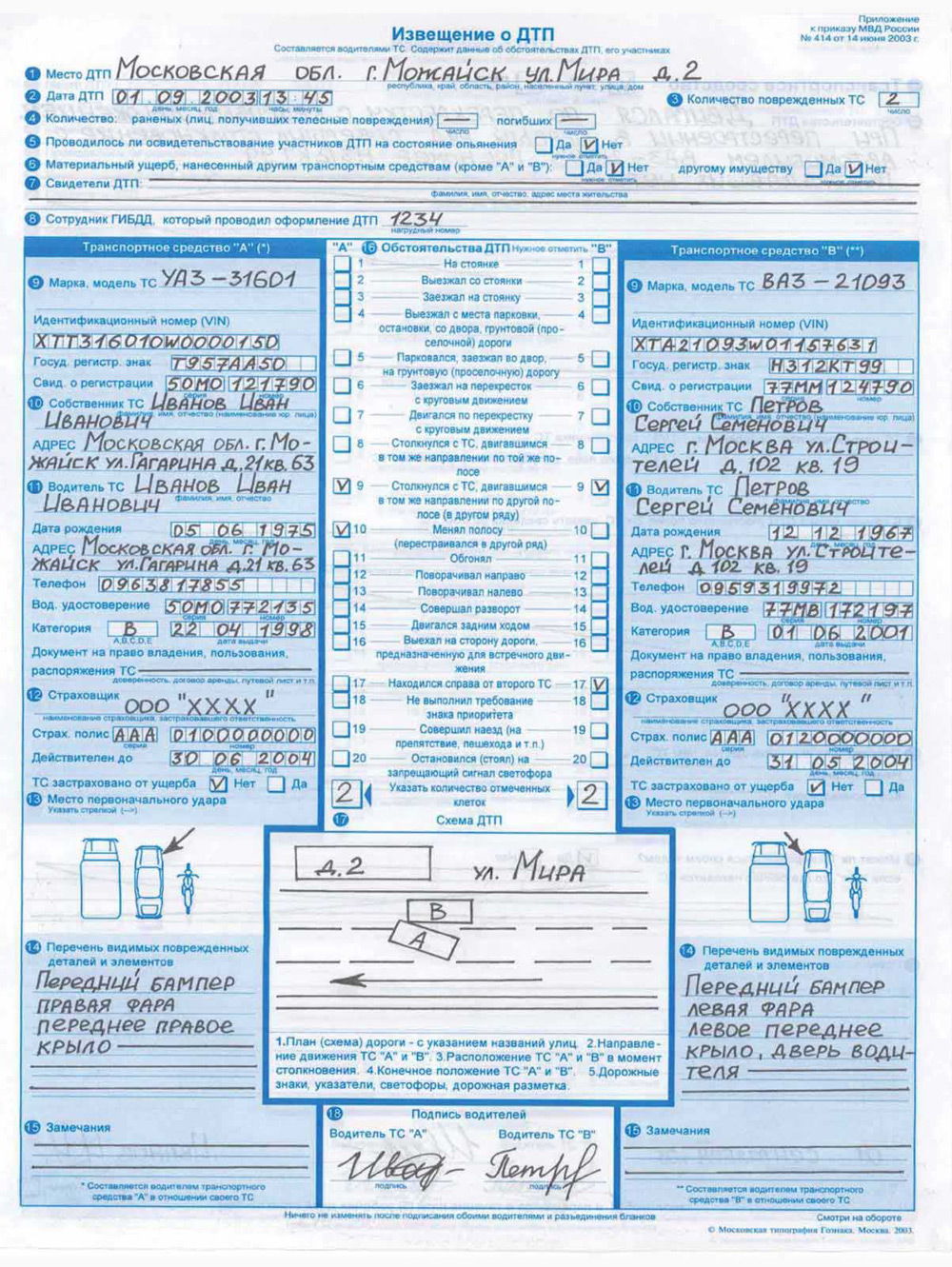

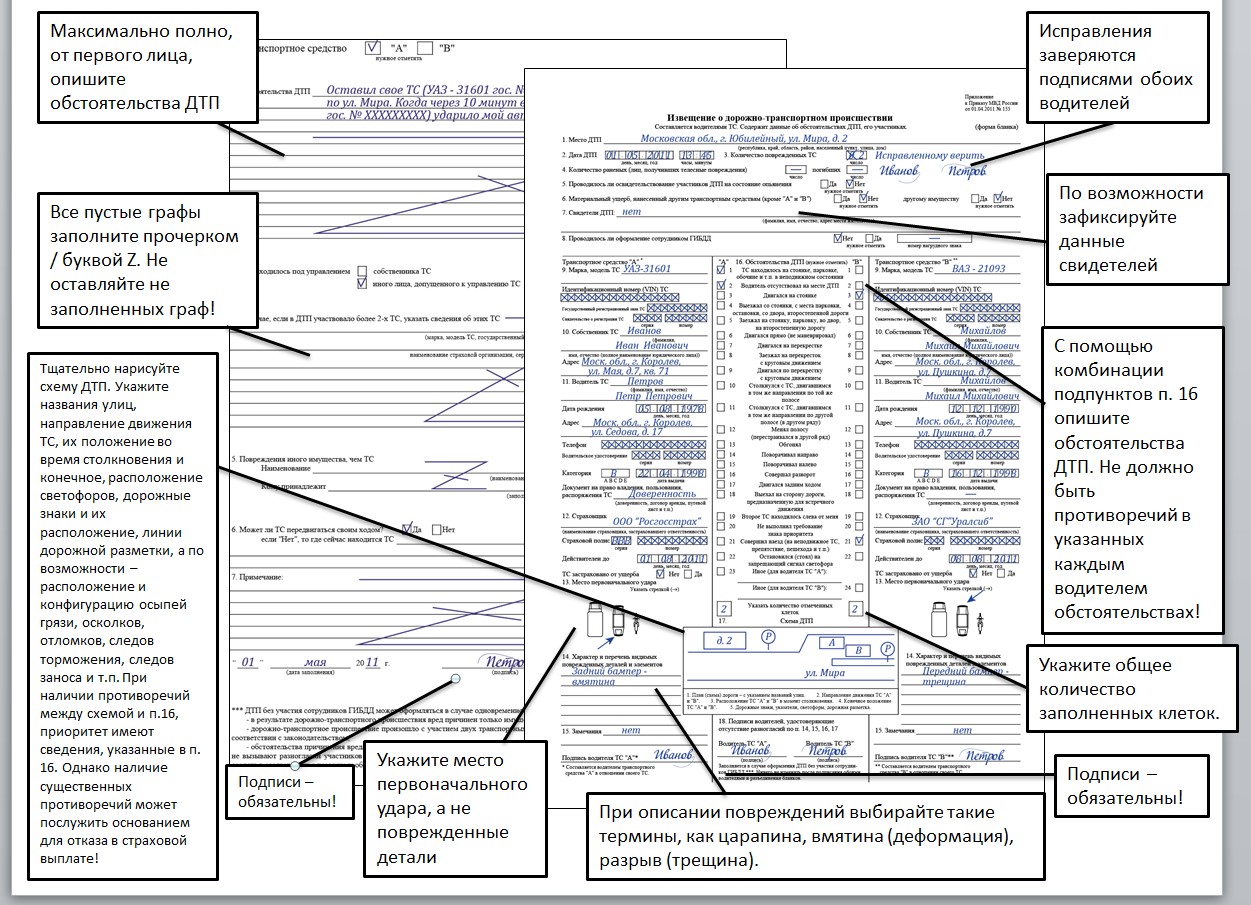

An accident notice is filled together with the second participant in the incident. In the header of the form contains general information about the accident:

- The address where the accident occurred.

- Day and time of events.

- Number of broken cars and affected people.

- Information was broken some other property except for cars.

- Name, surname and patronymic of witnesses (if available).

- Information about traffic police officers if they arrived at the accident site.

Next, the second part of the alarm notification is filled, containing information about cars. Each car owner fills his column, where indicates:

- Model and car brand.

- Identification factory vehicle number.

- State registration sign.

- The number and series of the certificate of registration of the car.

- Information about the owner of the car and its address of living.

- Details about the driver, his date of birth and the address of the residence.

- The number and series of a driver's license.

- Cell phone number of the driver.

- The validity period and the OSAGO policy number, the name of the insurance company.

- Circumstances of the accident.

- List of damage applied cars.

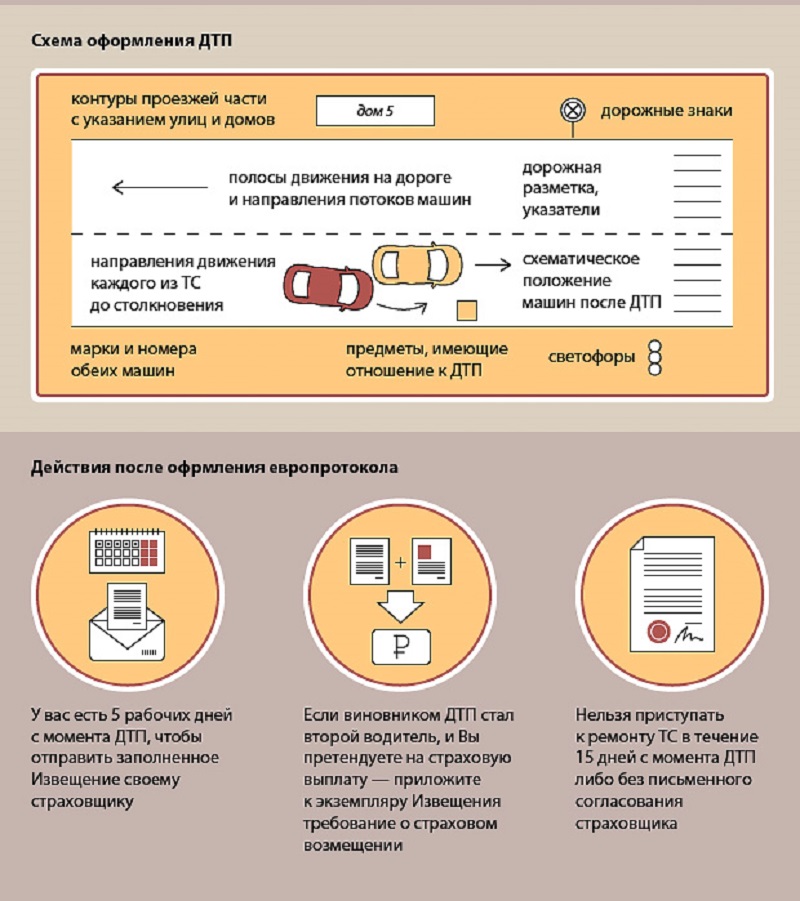

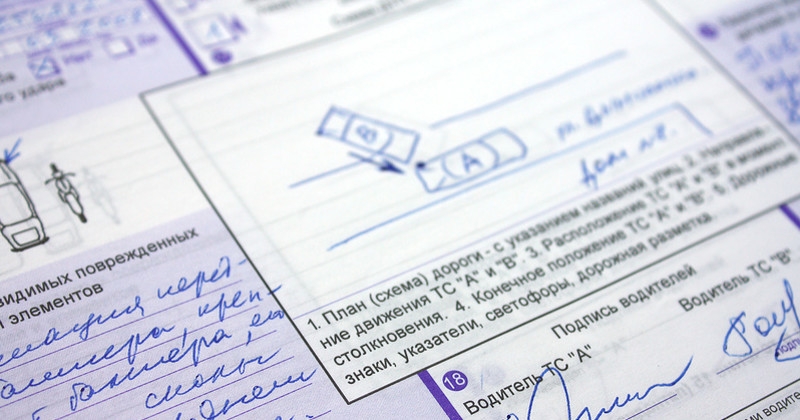

The accuracy of this information is confirmed by the signatures of the participants of the accident. Then in the lower part of the form draws a DTP scheme that drivers also assure their signatures.

When the facial part of the Europrotokol is filled, the self-copying form is divided and each participant has an accident remains its instance. The opposite side of motorists fill on their own. Here, it should be described as fully as possible that the insurance company does not have any questions about how cars received damage.

The design of the notice begins with the description of the circumstances of this event and information about who was driving the car at the time of the accident. Paragraphs 4 and 5 indicate information about damage to the accident of another property. However, as mentioned earlier, during the preparation of Europrotokol, in addition to two cars, it cannot be damaged, otherwise an accident must be fixed in the traffic police.

Already at the end of filling out the form of notice, it is necessary to note in the pole paragraph, whether the vehicle moves independently and its address of the location, if the car is not on the drive.

For which time it is necessary to notify your insurance company

In the insurance company, you must contact within five working days after the accident, otherwise the insurer may refuse to compensate for damage.

Tips Prof.

Undoubtedly, the accident is a stress of any, even a very experienced car owner. The design of an accident without traffic police with the help of Europrotokol will give the opportunity to avoid unnecessary unrest and without any problems to receive insurance payment, as well as save the time of the participants in the incident to expect traffic police.

Related Materials

- Stove 2110, bad warm stove 2110, VAZ 2110 heating system, repairing the heating system VAZ 2110 with their own hands

- VAZ 2114 stove blows with cold air, stove 2114, bad warm stove VAZ 2114, device and repair of heating VAZ 2114 do-it-yourself, removing the stove VAZ 2114

- How to subdominize the car. How to put a jack. Types of jacks for cars.

- VAZ 2109 Fuse Block, VAZ 2109 Fuse Block Carburetor, VAZ 2109 Fuse Block Injector, Old VAZ 2109 Fuse Block, VAZ 2109 Fuse Block, VAZ Fuse Block 2109

- Car exhaust gas catalyst, faulty catalyst, pluses and cons of the catalyst, how to change the catalyst for the planeencitel

- Stove blowing cold air VAZ 2114, badly blowing the stove VAZ 2114, why badly blowing the stove VAZ 2114

- How to find out the owner of the car by the number of his car, check the car by the number of the traffic police machine, check the car by the state number of the car for free

- How to choose Used tires, Useful Tips

- Winter car road, pressure in passenger car tires in winter, good battery for the car in winter, whether to warm the car in winter

- In winter, the car is poorly started. How to make a car in winter, do you need to warm up the car in winter, useful tips

- Economy fuel consumption machines, the most economical car consumption

- Tires brands for passenger cars, labeling of car tire labeling, residual passenger car tire protector, how to pick a tire on a car brand, car tire tread pattern

- Working transmission operation, mechanical gearbox clutch work, driving with manual gearbox, useful tips

- Rear beam Peugeot 206 sedan, rear beam device Peugeot 206. Rear beam Peugeot 206 Malfunction, repair of the rear beam Peugeot 206

- Diesel fuel in winter, additive for diesel fuel in winter, how to choose the best diesel fuel

- Diesel winter does not start. How to start diesel in winter, heating diesel in winter.

- Japanese bridgestone tires, winter studded bridgestone tires, bridgestone tires brand

- Tire marking decoding for passenger cars, labeling wheels, how to choose the right tires on the disks

- Diesel engine in winter, launch of the diesel engine in winter, what oil to fill in a diesel engine in winter, useful tips

- LED backlight of the car, the backlight of the bottom of the car, the backlight of the legs in the car, the backlight in the door of the car, the backlight of the car is fine

- Recovered tires, bus tire, restored tire protector, can I use them

- Choose winter tires, which is a winter tires, which pressure in winter tires should be marked with winter tires, how to choose the right winter tires, the best winter tires 2019

- Steering rail rail, knock of steering rack, reasons for the knock and repair of the steering rack do it yourself

- Cameless car tires, a set for repair of tubeless tires, repair of the cannon-free tire do it yourself

- Russian tires, Russian tires Winter, Russian All-season tires, Voronezh AMTEL tires, Tires "Matador Omsk Tire", Kama-tires are world-class bus

- How to open a car without a key. Lost the key from the car what to do, the key from the car inside the car

- Silent tires, quiet winter tires, quiet studded bus, which tires to choose, overview tires

- Tires and safety, safety of the bus, why it is necessary to constantly monitor car tires

- Rules of safe driving of the car in the rain and slush, safe driving of the car for beginners

- Rust converter which is better for cars, rust converters to choose how to use rust transducer, professionals

- Polishing the body of the car do it yourself, how to choose a polishing paste, useful tips

- Engine durability, engine life, how to extend engine life

- Knock in the car. Knock when moving the car. What can knock in the car. How to determine the cause of the knock.

- ABS car, what is ABS car, ABS system malfunction, ABS diagnostics

- Overtaking a car when you can start overtaking a car, rules of traffic rules

- Fuel pump VAZ 2110, VAZ 2110 gas station scheme, VAZ 2110 fuel pump device, VAZ 2110 gas station repair,

- Automotive antennas for radio, automotive antenna device, car antenna do it yourself

- Front suspension Kalina, device front suspension Kalina, knock in front suspension Kalina, repair of front suspension Kalina

- Shock absorber Oil, best oil shock absorbers, pumping oil shock absorbers, how to properly pump oil shock absorber

- Clutch malfunctions, touches clutch, causes a clutch malfunction, how to eliminate

Comments