Modern man without a car is nonsense. Not only work is connected with the car, but also the life activity of the family. In the morning you need to deliver children to the kindergarten or to school, then pick them up, take them away to additional classes, buy products, etc. And if you stay without a car is a catastrophe.

Well, if you have a free amount of money, it will allow you to purchase a new car without delay. And what if finance is not enough to buy a car? In this case, auto loan may come to the rescue. And if no reference needs for the loan, except for two documents - such a car loan can also be used by a person who has no official income. Such a car loan was gaining great popularity and many credit organizations issued such a loan. And if you make an initial contribution, you will show the bank to your solvency and serious intentions.

Content

Car loan what car loan for two documents

Car loan in two documents with an initial contribution is a type of receipt of money in a loan in order to buy a car.

Many banks give out such car loan, in each bank there may be special conditions of such a loan.

But, in terms of the specific requirements of each bank, all banks issue such a car loan on a common basis, which will be revealed below:

- on the purchase of a car, banks issue a sum that does not exceed 1,000,000 rubles. Such restrictions are explained by the fact that the bank risks without checking the customer's solvency. Based on this, the man taking a car loan is forced to buy a car within this amount, or make a major payment in the form of an advance;

- car loan will make a car quickly, as the Bank is considering an application for an autocredit for just a few hours. Since the bank does not check the customer's solvency, the borrower does not need a certificate of 2-NDFL. And we know how our organizations delay the issuance of various references. Freeing the client from spending time to receive certificates, individual banks decide the issue of issuing a loan for several minutes;

- the Bank's customer on the car loan must submit its passport to the bank, which includes registration and second document. The second document may be the driver's license, SNILS, INN, passport passport, etc.;

- the bank always risks providing such a loan if you have made an initial contribution in the form of 10%, car loan will receive a higher percentage. But if you work unofficially, you need to quickly buy a car (perhaps you are engaged in freight or passengers) - such a car loan is the only opportunity in the purchase of cars;

- having issuing such a loan, the bank wants to receive an additional guarantee that he will receive compensation, even in the case of a car hijacking or in case of obtaining a car of serious damage. Therefore, the Bank will require the mandatory design of the CASCO insurance policy.

Previously, you can make an autocredit for two documents, you can independently make a calculation on your bank contributions.

To do this, you need to know your initial contribution, the cost of the car, the loan period and taking advantage of this bank's credit calculator, you will get a digit, it will be the amount of money monthly payments.

In addition to the amount of the monthly payment, with the help of the calculator, you will consider and the amount of overpayment, as the law obliges banks to show such numbers to borrowers.

And yet, despite the overpayment, car loan in two documents is a very popular service.

And this is explained by the fact that the car you can buy quickly and you will not need official help to confirm your income.

Car loan on two documents, banks offer on car dealerships.

Taking advantage of such a program, you can get the car literally in one day.

Car loan, in which bank is more profitable to take car loan on two documents with the initial contribution

Russians, at the genetic level, are accustomed to trust Sberbank.

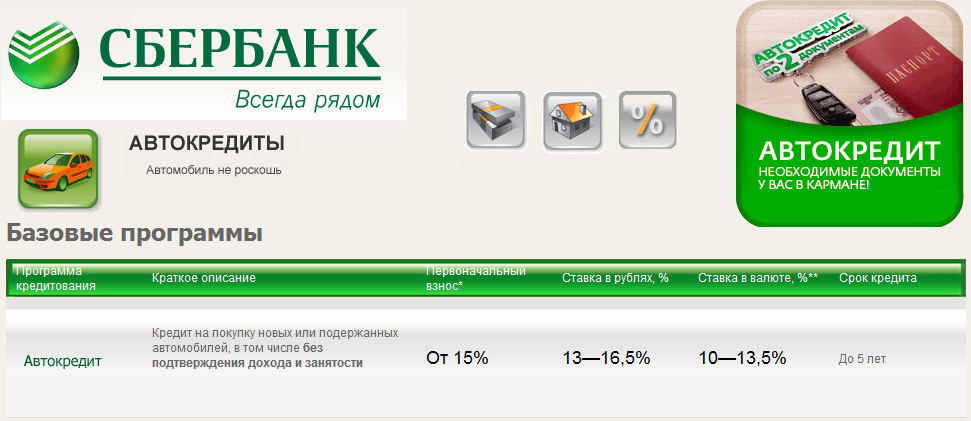

Sberbank, does not lag behind the fashion trend and offer you a car loan on two documents if you make an initial contribution for a car at least 30%. By entering such a large amount, you confirm your solvency and the ability to pay the loan timely.

And if you get a salary through Sberbank, the bank knows all your solvency and a schedule of receipt of your money.

Therefore, if you decide to contact Sberbank, go to the official website, use the Calculator and then decide whether you should acquire any car.

Usually Sberbank issues a loan for no more than 5 years, the maximum loan is 5,000,000 rubles.

In addition to Sberbank, other banks offer autocredit on two documents with an initial contribution.

Car loan "Plus Bank" allows you to purchase cars not only in the car dealership, but also in an individual.

Turning to a plus bank, you can get a loan for an hour. At the same time, the initial contribution is not required, Casco design is as not necessarily.

But in each barrel of honey there is a spoon of tar - such an auto loan will cost very expensive.

Rosbank will give you an autocredit of up to 1,000,000 rubles. The banking rate will be in average to 17.7%.

The loan will be issued for a period of up to 5 years, the initial contribution from 0 to 50%. The car must insure the Casco, the insurance price may include in the amount of car loan.

We conclude that car loans for two documents with the initial contribution are a very good option to obtain a car loan for the main population.

Of course, issuing such a loan, the bank risks, but also the borrower before you take a car loan should provide all of your capabilities.

Related Materials

- Stove 2110, bad warm stove 2110, VAZ 2110 heating system, repairing the heating system VAZ 2110 with their own hands

- VAZ 2114 stove blows with cold air, stove 2114, bad warm stove VAZ 2114, device and repair of heating VAZ 2114 do-it-yourself, removing the stove VAZ 2114

- How to subdominize the car. How to put a jack. Types of jacks for cars.

- VAZ 2109 Fuse Block, VAZ 2109 Fuse Block Carburetor, VAZ 2109 Fuse Block Injector, Old VAZ 2109 Fuse Block, VAZ 2109 Fuse Block, VAZ Fuse Block 2109

- Car exhaust gas catalyst, faulty catalyst, pluses and cons of the catalyst, how to change the catalyst on the planeencitel

- Stove blowing cold air VAZ 2114, badly blowing the stove VAZ 2114, why badly blowing the stove VAZ 2114

- How to find out the owner of the car by the number of his car, check the car by the number of the traffic police machine, check the car by the state number of the car for free

- How to choose Used tires, Useful Tips

- Winter car road, pressure in passenger car tires in winter, good battery for the car in winter, whether to warm the car in winter

- In winter, the car is poorly started. How to make a car in winter, do you need to warm up the car in winter, useful tips

- Economy fuel consumption machines, the most economical car consumption

- Tires brands for passenger cars, labeling of car tire labeling, residual passenger car tire protector, how to pick a tire on a car brand, car tire tread pattern

- Working transmission operation, mechanical gearbox clutch work, driving with manual gearbox, useful tips

- Rear beam Peugeot 206 sedan, rear beam device Peugeot 206. Rear beam Peugeot 206 Malfunction, repair of the rear beam Peugeot 206

- Diesel fuel in winter, additive for diesel fuel in winter, how to choose the best diesel fuel

- Diesel winter does not start. How to start diesel in winter, heating diesel in winter.

- Japanese bridgestone tires, winter studded bridgestone tires, bridgestone tires brand

- Tire marking decoding for passenger cars, labeling wheels, how to choose the right tires on the disks

- Diesel engine in winter, launch of the diesel engine in winter, what oil to fill in a diesel engine in winter, useful tips

- LED backlight of the car, the backlight of the bottom of the car, the backlight of the legs in the car, the backlight in the door of the car, the backlight of the car is fine

- Recovered tires, bus tire, restored tire protector, can I use them

- Choose winter tires, which is a winter tires, which pressure in winter tires should be marked with winter tires, how to choose the right winter tires, the best winter tires 2019

- Steering rail rail, knock of steering rack, reasons for the knock and repair of the steering rack do it yourself

- Cameless car tires, a set for repair of tubeless tires, repair of the cannon-free tire do it yourself

- Russian tires, Russian tires Winter, Russian All-season tires, Voronezh AMTEL tires, Tires "Matador Omsk Tire", Kama-tires are world-class bus

- How to open a car without a key. Lost the key from the car what to do, the key from the car inside the car

- Silent tires, quiet winter tires, quiet studded bus, which tires to choose, overview tires

- Tires and safety, safety of the bus, why it is necessary to constantly monitor car tires

- Rules of safe driving of the car in the rain and slush, safe driving of the car for beginners

- Rust converter which is better for cars, rust converters to choose how to use rust transducer, professionals

- Polishing the body of the car do it yourself, how to choose a polishing paste, useful tips

- Engine durability, engine life, how to extend engine life

- Knock in the car. Knock when moving the car. What can knock in the car. How to determine the cause of the knock.

- ABS car, what is ABS car, ABS system malfunction, ABS diagnostics

- Overtaking a car when you can start overtaking a car, rules of traffic rules

- Fuel pump VAZ 2110, VAZ 2110 gas station scheme, VAZ 2110 fuel pump device, VAZ 2110 gas station repair,

- Automotive antennas for radio, automotive antenna device, car antenna do it yourself

- Front suspension Kalina, device front suspension Kalina, knock in front suspension Kalina, repair of front suspension Kalina

- Shock absorber Oil, best oil shock absorbers, pumping oil shock absorbers, how to properly pump oil shock absorber

- Clutch malfunctions, touches clutch, causes a clutch malfunction, how to eliminate

Comments