If you often change the machines, you can use the BUY Back loan program. The BUY BACK program involves taking a car on credit with the possibility of a subsequent return of the car dealer on favorable terms. Car lists of European states actively use such practice, and in Russia such a program only begins to acquire popularity. Consider the program BUY Back or autocredit with a redemption and the purchase of a car with leasing in more detail.

Content

Reverse redemption what it is

By purchasing a car using a bank loan, you can get from the bank employees with a delayed payment.

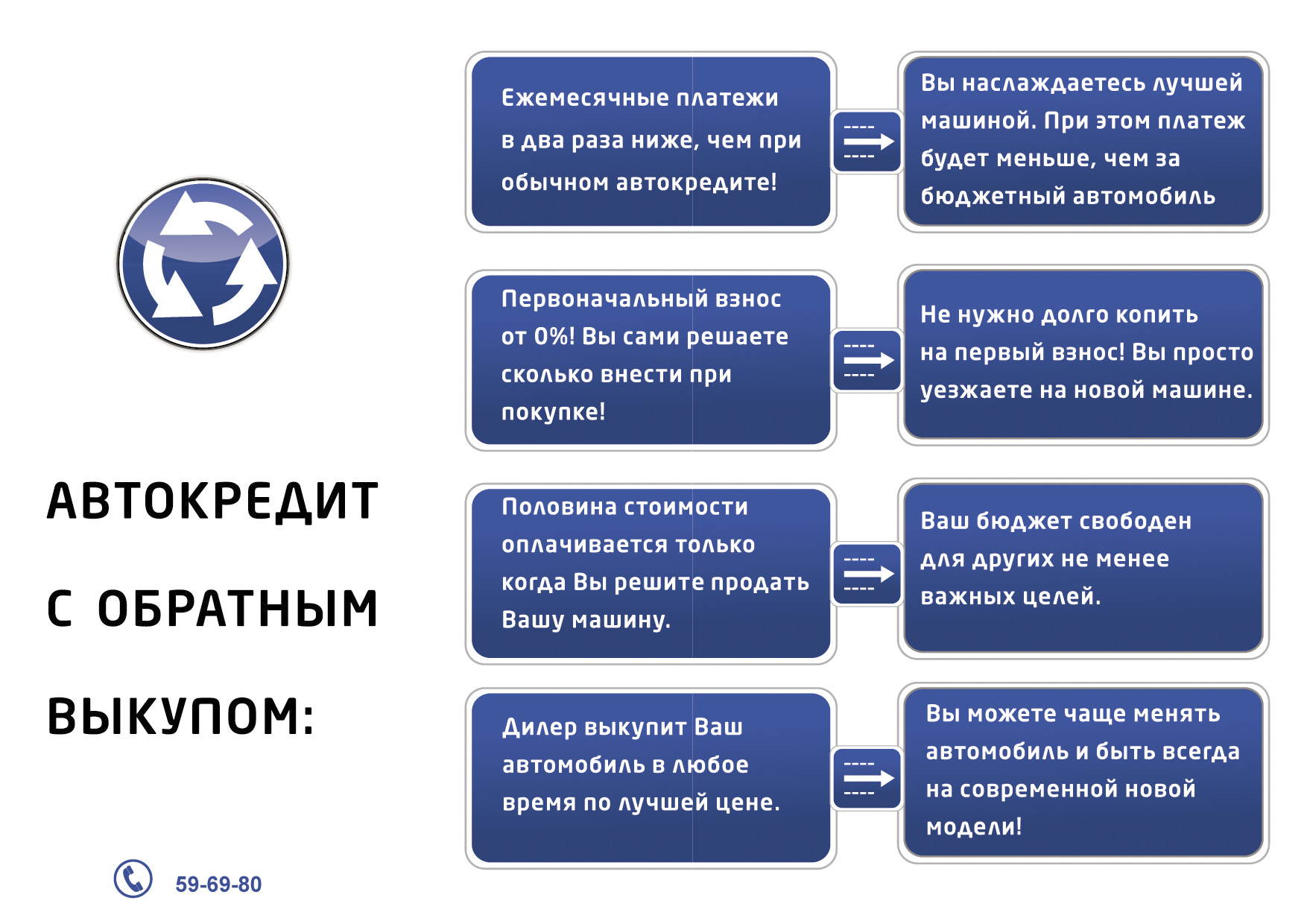

We offer to deal with this car loan:

- those who wish to acquire a new car with a bank loan under the buy back program can receive a loan from the bank to purchase a new foreign car machine. The borrower should make a major initial contribution. The amount of the contribution should be more or equal to 15% of the price of the car;

- the bank manager will offer you a delayed payment. Delayed payment can reach up to 50% of the cost of the machine, but it must be submitted at the very end of the credit period. Initially, the buyer's borrower has the right to pay a part of the loan by very small payments and at the lowest banking rate;

- under the contract, the program BUY BACK, until the end of the loan repayment, the borrower sells a car dealer. Having sold the car to the dealer, the borrower receives a certain amount in the hands, which is able to pay the remaining debt and the borrower still has money for the initial contribution to buy a new car. Thus, traveling for 2-3 years, the motorist sells the car to the dealer and acquires, again according to the program BUY BACK, a new car;

- but if the owner of the car does not want to part with the car, he must close his remaining debt with a high interest rate and in a short time, from 1 year to 2 years. Since the BUY BACK program is mainly designed for new, expensive cars, large amounts of money are involved.

Summing up the above, we come to the conclusion that on the BUY BACK system the carist pays for the car not more than half of its cost, but sometimes no more than 20% of the element price.

After 2-3 years, usually, the car bothers and sell it.

But using the BUY BACK system, you do not have to sell, as the dealer takes the car back and you immediately, according to the buy back program, get a new car.

Plus such a system is that it is not advantageous to leave the car itself, as the main part of the car's cost you will have to the overestimated rate in a short time.

For fans of frequent replacement cars - this is a great way out. Car dealerships are also beneficial to redemption system, because it increases from the car dealership turnover and the number of regular customers is increasing.

But everything is not as simple as it seems at first glance.

The car you used 2-3 years should be in excellent condition.

And if the car is in improper form, the car dealers can refuse its acceptance or agree to the return ransom at a low price.

With this situation, the motorist will have to repay the balance of the debt to the bank or pay the initial contribution to the next car from his pocket. The BUY BACK program has taken root in Western Europe, as there are good roads and fuel with high quality.

Machines in Western car owners have a very good appearance and after 10 years of operation, and on our Russian roads, a car can fall apart after a couple of years.

And if the owner pays a little time to his car, then he should be a good to think well before using the BUY BACK program.

Acquisition of a car on the leasing system, what it is

The car can be purchased from leasing banks.

The leasing of the car implies the acquisition of a car in property with lease.

Those. The motorist as if he takes a car for rent, but has the right to redeem. It is assumed that a person takes a car for the agreed time and pays the appointed amount of money in the form of car fees. By the end of the lease term, the carist in the end gives the amount of equal value of the car, plus the company's profit for services.

By paying the last installment, the client receives a full property machine. Car leasing is very popular due to:

- the possibility of acquiring the car by installments, and it is not necessary to use the services of banks. A person does not always have a white credit history and a stable official income - these reasons may affect the refusal of the Bank on the loan and under such conditions you can purchase a car only on leasing;

- the tenant is beneficial for rent with redemption, as while the car is leased, it does not pay property tax. According to the documents, for all time lease, the car is the property of a leasing company. It should be noted that some leasing organizations are simply a leased payment to be combined with transport tax and in this case cannot be saved;

- under the contract, the leasing company takes responsibility for the car in the form of insurance, maintenance, if the car has fallen into an accident, the landlord leads negotiations with the insurance company, etc. On the car tenant, there are responsibilities for the fulfillment of the terms of the contract;

- the leasing rent makes the lack of a large initial contribution, the rental of the first month is allowed, and if the car does not suit the tenant, it can refuse lease and search another car.

We told you all positive moments, and now let's say about the minuses.

And the underwater stone is that until the most recent payment, the car will be someone else, as the leasing company has the right to terminate the contract due to violations.

If the tenant will miss the payment timing and other retreats from the contract, the company can break the contract and without a court decision.

Because of your optional execution of the contract, you can lose all the money invested in the car.

This money is considered not paying for the car, but a car rental board.

What kind of car purchase option is the best

It all depends only on you and from the circumstances.

The leasing system more enjoy the entrepreneurs, and people who want to buy a car in private use are used by the loan.

What option is the best for you, decide for yourself.

Related Materials

- Stove 2110, bad warm stove 2110, VAZ 2110 heating system, repairing the heating system VAZ 2110 with their own hands

- VAZ 2114 stove blows with cold air, stove 2114, bad warm stove VAZ 2114, device and repair of heating VAZ 2114 do-it-yourself, removing the stove VAZ 2114

- How to subdominize the car. How to put a jack. Types of jacks for cars.

- VAZ 2109 Fuse Block, VAZ 2109 Fuse Block Carburetor, VAZ 2109 Fuse Block Injector, Old VAZ 2109 Fuse Block, VAZ 2109 Fuse Block, VAZ Fuse Block 2109

- Car exhaust gas catalyst, faulty catalyst, pluses and cons of the catalyst, how to change the catalyst on the planeencitel

- Stove blowing cold air VAZ 2114, badly blowing the stove VAZ 2114, why badly blowing the stove VAZ 2114

- How to find out the owner of the car by the number of his car, check the car by the number of the traffic police machine, check the car by the state number of the car for free

- How to choose Used tires, Useful Tips

- Winter car road, pressure in passenger car tires in winter, good battery for the car in winter, whether to warm the car in winter

- In winter, the car is poorly started. How to make a car in winter, do you need to warm up the car in winter, useful tips

- Economy fuel consumption machines, the most economical car consumption

- Tires brands for passenger cars, labeling of car tire labeling, residual passenger car tire protector, how to pick a tire on a car brand, car tire tread pattern

- Working transmission operation, mechanical gearbox clutch work, driving with manual gearbox, useful tips

- Rear beam Peugeot 206 sedan, rear beam device Peugeot 206. Rear beam Peugeot 206 Malfunction, repair of the rear beam Peugeot 206

- Diesel fuel in winter, additive for diesel fuel in winter, how to choose the best diesel fuel

- Diesel winter does not start. How to start diesel in winter, heating diesel in winter.

- Japanese bridgestone tires, winter studded bridgestone tires, bridgestone tires brand

- Tire marking decoding for passenger cars, labeling wheels, how to choose the right tires on the disks

- Diesel engine in winter, launch of the diesel engine in winter, what oil to fill in a diesel engine in winter, useful tips

- LED backlight of the car, the backlight of the bottom of the car, the backlight of the legs in the car, the backlight in the door of the car, the backlight of the car is fine

- Recovered tires, bus tire, restored tire protector, can I use them

- Choose winter tires, which is a winter tires, which pressure in winter tires should be marked with winter tires, how to choose the right winter tires, the best winter tires 2019

- Steering rail rail, knock of steering rack, reasons for the knock and repair of the steering rack do it yourself

- Cameless car tires, a set for repair of tubeless tires, repair of the cannon-free tire do it yourself

- Russian tires, Russian tires Winter, Russian All-season tires, Voronezh AMTEL tires, Tires "Matador Omsk Tire", Kama-tires are world-class bus

- How to open a car without a key. Lost the key from the car what to do, the key from the car inside the car

- Silent tires, quiet winter tires, quiet studded bus, which tires to choose, overview tires

- Rules of safe driving of the car in the rain and slush, safe driving of the car for beginners

- Rust converter which is better for cars, rust converters to choose how to use rust transducer, professionals

- Polishing the body of the car do it yourself, how to choose a polishing paste, useful tips

- Engine durability, engine life, how to extend engine life

- Knock in the car. Knock when moving the car. What can knock in the car. How to determine the cause of the knock.

- ABS car, what is ABS car, ABS system malfunction, ABS diagnostics

- Overtaking a car when you can start overtaking a car, rules of traffic rules

- Fuel pump VAZ 2110, VAZ 2110 gas station scheme, VAZ 2110 fuel pump device, VAZ 2110 gas station repair,

- Automotive antennas for radio, automotive antenna device, car antenna do it yourself

- Front suspension Kalina, device front suspension Kalina, knock in front suspension Kalina, repair of front suspension Kalina

- Shock absorber Oil, best oil shock absorbers, pumping oil shock absorbers, how to properly pump oil shock absorber

- Clutch malfunctions, touches clutch, causes a clutch malfunction, how to eliminate

- Viscounts of the fan, work uniforms of the fan, malfunction of the ventilator fan, repair of the ventilator fan

Comments