Today, the policy of OSAGO is mandatory for every citizen of our country owned vehicle. When making this policy for car owners who have excellent ride quality data, certain discounts are provided. What are these discounts and how to get them - read further in the article.

Content

- Cost of CTP, from which the cost of the CTP depends

- Driver Insurance Class, how it affects the price of insurance

- Driver class, how to find out the driver's class on CTP

- KBM, what is the coefficient and as a driver to know his KBM, how to use the table to determine the KBM

- OSAGO 2017 policy, which is waiting for the driver

- Council Profi: as a disciplined driver can accumulate by 50% discount

Cost of CTP, from which the cost of the CTP depends

An important element in the insurance insurance is the CBM coefficient (Bonus-Malyus coefficient) is a special indicator that affects the amount of payments. It is with the help of this coefficient that the amount of insurance payments for the decorated policy can be reduced.

Driver Insurance Class, how it affects the price of insurance

When making insurance, the driver class plays a major role in generating the cost of the service. The cost calculation is carried out on the basis of such data:

- The place of residence - in each region there is its own traffic accident statistics, therefore, the coefficient is determined on the basis of statistical analysis.

- For each type of transport, its tariff is set - passenger cars, freight vehicles, buses.

- For each model and the brand, special rates are developed, given the frequency of their hit in the accident.

- For young drivers, higher coefficients are installed, for mature drivers - lower. Also in this category, you can add a driver's experience that does not rarely depends on the age of the car owner.

- Driving history - depending on this indicator, insurance services determine the driver's class and calculate the CBM.

Driver class, how to find out the driver's class on CTP

According to the CTP system, there are such classes - "0", "M", "1", "2" and so on to "13". If the driver's insurance history is missing, the "1" coefficient is automatically installed. This means that when calculating the price, all the factors listed above are taken into account, in addition to the fifth. Every year the trouble-free drive will be taking a higher class.

To find out the driver's class, you should familiarize yourself with the data presented on the website of the Russian Union of motorways and on other information resources that give such an opportunity. To check, you must enter such information in the database - the driver's license number, date of birth and name. After entering information, all data relating to the insurance history of a certain driver will be available. Thus, it is possible to obtain the information you want regardless of the company providing services or the date of registration of insurance.

This system is useful and drivers, and insurance companies. Motorists can get relevant data even during reissuing insurance, and with a new design of the CTP, the data remained from previous insurance. As for insurers, they can check the data on the driver even in case of changing the company and the conclusion of new insurance, which prevents possible fraud when the car owner decreases the class and to increase it, a new documentation is preparing.

The general database of drivers is available in all insurance firms engaged in the issuance of OSAGO policies. The database is completed, they also do.

KBM, what is the coefficient and as a driver to know his KBM, how to use the table to determine the KBM

The driver has data on its own class. However, the class itself is no more than the alphabetic designation of the CBM coefficient. This indicator is the only method of reducing the amount of insurance payments. All data considered in this article on the class classes for the most part and to KBM.

Previously, CBM was used only for a particular vehicle, so when the car sells an extra cost or a discount on insurance disappeared. In this case, the driver had to earn new points to get a discount. In 2008, the system has changed, and since 2016, CBM began to assign not a car, but the driver himself. This means that regardless of the insurer or the car, the KBM remains at the driver a single indicator.

To check the CBM of the RCA motorist, the steps described above should be made, then begin to calculate their own insurance rate on the OSAGO. To find out the data on the CBM on the following table below, you need to know only your own class, as well as the number of insurance payments for the year.

When using the table, you should be guided by such provisions:

- When typing primary insurance, the driver is assigned the third class.

- The number of insured cases is determined by the driver's fault for the year of insurance. If the insurance claims did not occur, the driver receives an increased class for the next year. If there is one insurance indemnity, the next year the car owner will receive "1" class, in the case of two compensations - "M" class and so on.

- In the absence of insurance compensation and an increase in the class from the third (initial) to the fourth, the CBM coefficient will be 0.95.

OSAGO 2017 policy, which is waiting for the driver

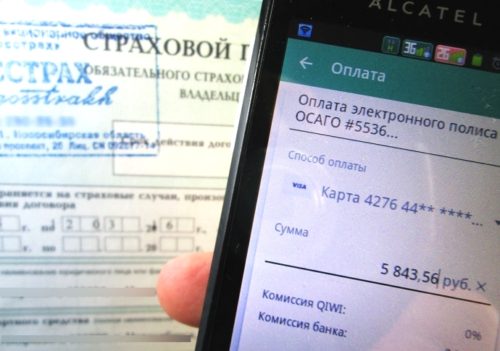

The main change in the policy of the OSAGO - since first of January 2017, insurance companies that operate in the OSAGO market will be required to sell electronic policies. At the same time, the requirement to "ensure the continuity and smoothness of the functioning of their sites" have been added to the insurance companies, and when technical problems appear, the Insurer must immediately report it to the Central Bank.

Council Profi: as a disciplined driver can accumulate by 50% discount

Based on the foregoing, it can be concluded that the Insurance of the OSAO provides a fairly flexible cumulative system for the driver, which, with good insurance history, is able to reach 50 percent. This means that when receiving the maximum class, the car owner can replenish insurance two times cheaper than its standard cost.

Related Materials

- Stove 2110, bad warm stove 2110, VAZ 2110 heating system, repairing the heating system VAZ 2110 with their own hands

- VAZ 2114 stove blows with cold air, stove 2114, bad warm stove VAZ 2114, device and repair of heating VAZ 2114 do-it-yourself, removing the stove VAZ 2114

- How to subdominize the car. How to put a jack. Types of jacks for cars.

- VAZ 2109 Fuse Block, VAZ 2109 Fuse Block Carburetor, VAZ 2109 Fuse Block Injector, Old VAZ 2109 Fuse Block, VAZ 2109 Fuse Block, VAZ Fuse Block 2109

- Car exhaust gas catalyst, faulty catalyst, pluses and cons of the catalyst, how to change the catalyst for the planeencitel

- Stove blowing cold air VAZ 2114, badly blowing the stove VAZ 2114, why badly blowing the stove VAZ 2114

- How to find out the owner of the car by the number of his car, check the car by the number of the traffic police machine, check the car by the state number of the car for free

- How to choose Used tires, Useful Tips

- Winter car road, pressure in passenger car tires in winter, good battery for the car in winter, whether to warm the car in winter

- In winter, the car is poorly started. How to make a car in winter, do you need to warm up the car in winter, useful tips

- Economy fuel consumption machines, the most economical car consumption

- Tires brands for passenger cars, labeling of car tire labeling, residual passenger car tire protector, how to pick a tire on a car brand, car tire tread pattern

- Working transmission operation, mechanical gearbox clutch work, driving with manual gearbox, useful tips

- Rear beam Peugeot 206 sedan, rear beam device Peugeot 206. Rear beam Peugeot 206 Malfunction, repair of the rear beam Peugeot 206

- Diesel fuel in winter, additive for diesel fuel in winter, how to choose the best diesel fuel

- Diesel winter does not start. How to start diesel in winter, heating diesel in winter.

- Japanese bridgestone tires, winter studded bridgestone tires, bridgestone tires brand

- Tire marking decoding for passenger cars, labeling wheels, how to choose the right tires on the disks

- Diesel engine in winter, launch of the diesel engine in winter, what oil to fill in a diesel engine in winter, useful tips

- LED backlight of the car, the backlight of the bottom of the car, the backlight of the legs in the car, the backlight in the door of the car, the backlight of the car is fine

- Recovered tires, bus tire, restored tire protector, can I use them

- Choose winter tires, which is a winter tires, which pressure in winter tires should be marked with winter tires, how to choose the right winter tires, the best winter tires 2019

- Steering rail rail, knock of steering rack, reasons for the knock and repair of the steering rack do it yourself

- Cameless car tires, a set for repair of tubeless tires, repair of the cannon-free tire do it yourself

- Russian tires, Russian tires Winter, Russian All-season tires, Voronezh AMTEL tires, Tires "Matador Omsk Tire", Kama-tires are world-class bus

- How to open a car without a key. Lost the key from the car what to do, the key from the car inside the car

- Silent tires, quiet winter tires, quiet studded bus, which tires to choose, overview tires

- Tires and safety, safety of the bus, why it is necessary to constantly monitor car tires

- Rules of safe driving of the car in the rain and slush, safe driving of the car for beginners

- Rust converter which is better for cars, rust converters to choose how to use rust transducer, professionals

- Polishing the body of the car do it yourself, how to choose a polishing paste, useful tips

- Engine durability, engine life, how to extend engine life

- Knock in the car. Knock when moving a car. What can knock in the car. How to determine the cause of the knock.

- ABS car, what is ABS car, ABS system malfunction, ABS diagnostics

- Overtaking a car when you can start overtaking a car, rules of traffic rules

- Fuel pump VAZ 2110, VAZ 2110 gas station scheme, VAZ 2110 fuel pump device, VAZ 2110 gas station repair,

- Automotive antennas for radio, automotive antenna device, car antenna do it yourself

- Front suspension Kalina, device front suspension Kalina, knock in front suspension Kalina, repair of front suspension Kalina

- Shock absorber Oil, best oil shock absorbers, pumping oil shock absorbers, how to properly pump oil shock absorber

- Clutch malfunctions, touches clutch, causes a clutch malfunction, how to eliminate

Comments