The car is not a luxury but a means of transportation - it is known to every Russian.

Modern life is impossible without a car, and not only because:

- via the vehicle is easy to get from point A to point B;

- using the car can deliver cargo to the destination;

- car - is the source for the existence of many families.

According to our legislation, all driven transport - is the object of taxation. Every owner who has registered vehicle must pay the tax. At the same time, the amount of tax is not a constant value, and changes regularly. Therefore, if the car owner wants to know how much he must pay for his vehicle so as not to run into the penalty for failure to pay tax, inquisitive motorist by reading this article, can obtain information about the principle of the calculation of the transport tax and try to calculate the amount of vehicle tax on their the car with the help of a calculator vehicle tax.

Content

Vehicle tax, who is exempt from tax on vehicles

On the basis of the Russian Tax Code, article 358 of the Code exempts from the tax on nizheperechislenny list of vehicles:

- from tax osvobozhdayutsyavse boats with oars;

- from tax exempt all motor boats, the engine power is less than 5 horsepower;

- from the payment of tax, the personal transport of persons with disabilities, which received passenger cars through social protection bodies and if the power of these cars is not more than 100 hp;

- frequently from taxes All field marine and river ships;

- released from the tax river and maritime, cargo and passenger vessels, which are registered by both private entrepreneurs and legal entities whose main activity is freight and passenger transportation;

- all agricultural vehicles are liberated from taxes, in the form of combines, tractors and special services of agricultural.All listed vehicles must be the property of agricultural enterprises and should be used for its intended purpose;

- tax exemption is subject to all transport, which is registered with the executive authorities;

- the entire transport is exempt from the tax, which is listed on the balance of militarized structures;

- exempt from taxes in vain vehicles, which is listed wanted;

- frequently from tax transport of medical service in the form of helicopters and aircraft;

- all vessels made to the International Register of the Russian Federation are exempt from tax.

Transport tax how to calculate transport tax

Transport tax is calculated by the simplest formula.

To get the amount of transport tax, you need to know the tax rate and the power of transport, expressed in horsepower.

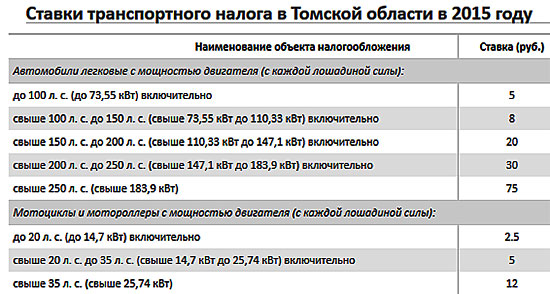

The Tax Code, to calculate the amount of tax on transport provided for a table:

Transport tax rate on auto [Region] for 2015-2016

| Name of the object of taxation | Bet (rub.) |

|---|---|

| Cars passenger with engine power (from each horsepower): | |

| up to 100 liters. with. (up to 73.55 kW) inclusive | 20 |

| over 100 liters. with. up to 150 liters. with. (Over 73.55 kW to 110.33 kW) inclusive | 30 |

| over 150 liters. with. up to 200 liters. with. (Over 110.33 kW to 147.1 kW) inclusive | 50 |

| over 200 l. with. up to 250 liters. with. (Over 147.1 kW to 183.9 kW) inclusive | 75 |

| over 250 liters. with. (Over 183.9 kW) | 150 |

But the car owner should know that each region has the right to make their own adjustments to this table and therefore the tax on the same car will cost differently in different regions.

Therefore, in order not to get to write, find out the cost of the tax rate on your car's power in your area.

The entire calculation of the transport tax is based on the power of the engine of your car, which is specified in the car's technical passport.

If the auto owner replaced the engine from his car, he is obliged to register a replacement in the traffic police and make changes to the documentation.

In the case of the transition of the vehicle from one to another, both sides pay for transport tax.

At the same time, the calendar month of registration of the transfer of ownership to the car from one owner to another, rounded to a full month.

The calculation of the transport tax with the help of the calculator directly depends on the region, from the type of car, from the power of the car in the horsepower, from the registration period and from year.

By choosing a calculator in accordance with the year for which your tax is paid (2015, 2016, etc.), specifying the region - you will easily calculate your tax.

Transport tax physical face

The transport tax is paid not only by the owners of passenger transport, but also the tax on any other type of transport, which is available from the car owner (if this transport is not exempted from paying tax).

The owner receives a receipt at the place of residence on the payment of transport tax from the tax inspectorate.

There are no cases of coincidence of the tax amount noted in the receipt, from the tax inspection, with the amount of tax you have to be calculated.

With this situation, you will have to seek explanations to the tax inspection, at the place of registration of your transport.

Transport tax to legal entities

Transport tax of legal entities is calculated by the same formula as the tax for individuals.

But, legal entities should make a report for each quarter and this report determines the advance payments.

For each region there is a different advance payment of the transport tax.

But in any case, legal entities calculate the sum of transport tax and the amount of advance contributions - personally.

Transport tax, how to pay tax

Legal entities can produce transport tax payments combining an advance payment tax, and if they do not make an advance payment, then a lump sum payment is made instead.

One-time payment of transport tax is done in the case when the advance payments in the region are not established.

And if there is a system of advance contributions, it first pays 25% of the total payment, and the remaining amount is paid at the end of the estimated period.

Separate regions in the calculation of the amount of tax include the time of operation of the vehicle, in which case, when calculating the amount of transport tax, you need to know how many years your car.

Age of the car is not considered from the date of issue, and in January the following year.

Vehicle tax is calculated not for the current year and in the past.

Summing up, the amount of vehicle tax depends on:

- powered vehicle in horsepower;

- on the region in which the vehicle is registered;

- age of the car.

Vehicle tax, the nuances of transport tax

In general, the amount of vehicle tax depends on the time, the number of months of registration of the vehicle on a particular car owners.

If vehicles registered less than a year, there is a calculation of the tax monthly, but at the same time less than a month is considered to be complete.

If vehicles sold by power of attorney, the actual owner is obliged, by law, to pay motor vehicle tax.

If the vehicle is stolen, the tax office must provide a certificate, the fact of the theft, and the vehicle detection, the owner is exempt from.

Vehicle tax, which threatens to non-payment of

If you have not paid the tax on time, will have to immediately pay the fine. amount of the fine depends on the amount of arrears, from the time delay and the refinancing rate.

If the fine is not paid, the case to the court. If the court proves that the late payment - your fault, the court will issue a decree for the recovery of this amount.

The case will give the bailiffs, who have the right to write off the unpaid amount of force the debtor accounts.

Bailiffs have the right to restrict the debtor's departure abroad, may restrict the rights of private transport, the motorist can not get a ticket for passage of technical inspection.

If the car owner with a long transport tax wish to sell your car, the car does not withdraw from the account to repay debts.

Tip - pay your taxes on time, especially since the money goes to repair and construction of roads, pits and potholes on the roads - the merit of unscrupulous taxpayers.

Related Materials

- Stove 2110, bad warm stove 2110, VAZ 2110 heating system, repairing the heating system VAZ 2110 with their own hands

- VAZ 2114 stove blows with cold air, stove 2114, bad warm stove VAZ 2114, device and repair of heating VAZ 2114 do-it-yourself, removing the stove VAZ 2114

- How to subdominize the car. How to put a jack. Types of jacks for cars.

- VAZ 2109 Fuse Block, VAZ 2109 Fuse Block Carburetor, VAZ 2109 Fuse Block Injector, Old VAZ 2109 Fuse Block, VAZ 2109 Fuse Block, VAZ Fuse Block 2109

- Car exhaust gas catalyst, faulty catalyst, pluses and cons of the catalyst, how to change the catalyst on the planeencitel

- Stove blowing cold air VAZ 2114, badly blowing the stove VAZ 2114, why badly blowing the stove VAZ 2114

- How to find out the owner of the car by the number of his car, check the car by the number of the traffic police machine, check the car by the state number of the car for free

- How to choose Used tires, Useful Tips

- Winter car road, pressure in passenger car tires in winter, good battery for the car in winter, whether to warm the car in winter

- In winter, the car is poorly started. How to make a car in winter, do you need to warm up the car in winter, useful tips

- Economy fuel consumption machines, the most economical car consumption

- Brand passenger car tires, decoding marking car tires remaining tread tires of the car, how to choose the tires for the car brand, car tire tread pattern

- Working transmission operation, mechanical gearbox clutch work, driving with manual gearbox, useful tips

- Rear beam Peugeot 206 sedan, rear beam device Peugeot 206. Rear beam Peugeot 206 Malfunction, repair of the rear beam Peugeot 206

- Diesel fuel in winter, additive for diesel fuel in winter, how to choose the best diesel fuel

- Diesel winter does not start. How to start diesel in winter, heating diesel in winter.

- Japanese bridgestone tires, winter studded bridgestone tires, bridgestone tires brand

- Tire marking decoding for passenger cars, labeling wheels, how to choose the right tires on the disks

- Diesel engine in winter, launch of the diesel engine in winter, what oil to fill in a diesel engine in winter, useful tips

- LED backlight of the car, the backlight of the bottom of the car, the backlight of the legs in the car, the backlight in the door of the car, the backlight of the car is fine

- Recovered tires, bus tire, restored tire protector, can I use them

- Choose winter tires, which is a winter tires, which pressure in winter tires should be marked with winter tires, how to choose the right winter tires, the best winter tires 2019

- Steering rail rail, knock of steering rack, reasons for the knock and repair of the steering rack do it yourself

- Cameless car tires, a set for repair of tubeless tires, repair of the cannon-free tire do it yourself

- Russian tires, Russian tires Winter, Russian All-season tires, Voronezh AMTEL tires, Tires "Matador Omsk Tire", Kama-tires are world-class bus

- How to open a car without a key. Lost the key from the car what to do, the key from the car inside the car

- Silent tires, quiet winter tires, quiet studded bus, which tires to choose, overview tires

- Tires and safety, safety of the bus, why it is necessary to constantly monitor car tires

- Rules of safe driving of the car in the rain and slush, safe driving of the car for beginners

- Rust converter which is better for cars, rust converters to choose how to use rust transducer, professionals

- Polishing the body of the car do it yourself, how to choose a polishing paste, useful tips

- Engine durability, engine life, how to extend engine life

- Knock in the car. Knock when moving the car. What can knock in the car. How to determine the cause of the knock.

- ABS car, what is ABS car, ABS system malfunction, ABS diagnostics

- Overtaking a car when you can start overtaking a car, rules of traffic rules

- Fuel pump VAZ 2110, VAZ 2110 gas station scheme, VAZ 2110 fuel pump device, VAZ 2110 gas station repair,

- Automotive antennas for radio, automotive antenna device, car antenna do it yourself

- Front suspension Kalina, device front suspension Kalina, knock in front suspension Kalina, repair of front suspension Kalina

- Shock absorber Oil, best oil shock absorbers, pumping oil shock absorbers, how to properly pump oil shock absorber

- Clutch malfunctions, touches clutch, causes a clutch malfunction, how to eliminate

Comments