Danas je politika Osaga obvezna za svakog građanina vozila u vlasništvu naših zemalja. Prilikom izrade ove politike za vlasnike automobila koji imaju izvrsne podatke o kvaliteti vožnje, osigurani su određeni popusti. Koji su ti popusti i kako ih dobiti - pročitati dalje u članku.

Sadržaj

- Trošak CTP-a, od kojih ovisi trošak CTP-a

- Klasa osiguranja vozača, kako to utječe na cijenu osiguranja

- Klasa vozača, kako saznati nastavu vozača na CTP-u

- KBM, što je koeficijent i kao vozač znati svoj KBM, kako koristiti tablicu kako bi odredio KBM

- Osago 2017 politika, koja čeka vozača

- Vijeće Profi: kao disciplinirani upravljački program može akumulirati za 50% popusta

Trošak CTP-a, od kojih ovisi trošak CTP-a

Važan element u osiguranju osiguranja je CBM koeficijent (bonus-malyus koeficijent) je poseban pokazatelj koji utječe na iznos plaćanja. Uz pomoć ovog koeficijenta može se smanjiti količina plaćanja osiguranja za ukrašenu politiku.

Klasa osiguranja vozača, kako to utječe na cijenu osiguranja

Prilikom stvaranja osiguranja, klasa vozača igra važnu ulogu u stvaranju troškova usluge. Izračun troškova provodi se na temelju takvih podataka:

- Mjesto prebivališta - u svakoj regiji postoji vlastita statistika prometne nesreće, dakle, koeficijent se određuje na temelju statističke analize.

- Za svaku vrstu prijevoza, njegova tarifa je postavljena - osobna vozila, teretna vozila, autobusi.

- Za svaki model i brand, razvijene su posebne stope, s obzirom na učestalost njihovog udarca u nesreći.

- Za mlade vozače su instalirani viši koeficijenti, za zrele upravljačke programe - niže. Također u ovoj kategoriji možete dodati iskustvo vozača koje ne rijetko ne ovisi o dobi od vlasnika automobila.

- Povijest vožnje - ovisno o ovom indikatoru, osiguravajuće usluge određuju nastavu vozača i izračunajte CBM.

Klasa vozača, kako saznati nastavu vozača na CTP-u

Prema CTP sustavu, postoje takve klase - "0", "m", "1", "2" i tako dalje "13". Ako se nedostaje povijest osiguranja vozača, koeficijent "1" se automatski instalira. To znači da prilikom izračunavanja cijene, svi gore navedeni čimbenici uzimaju u obzir, uz petu. Svake godine voziti nevolji će preuzeti višu klasu.

Da biste saznali nastavu vozača, trebali biste se upoznati s podacima predstavljenim na web stranici Ruske Unije autocesta i drugim informacijskim resursima koji daju takvu priliku. Da biste provjerili, morate unijeti takve informacije u bazu podataka - broj vozačke dozvole, datum rođenja i ime. Nakon unosa podataka, bit će dostupni svi podaci koji se odnose na povijest osiguranja određenog vozača. Dakle, moguće je dobiti informacije koje želite bez obzira na pružanje usluga koje pruža usluge ili datum registracije osiguranja.

Ovaj sustav je koristan i vozači i osiguravajuća društva. Vozači mogu dobiti relevantne podatke čak i za vrijeme preusmjeravanja osiguranja, a s novim dizajnom CTP-a, podaci su ostali iz prethodnog osiguranja. Što se tiče osiguravatelja, oni mogu provjeriti podatke na vozaču čak iu slučaju promjene tvrtke i zaključka novog osiguranja, što sprječava moguću prijevaru kada vlasnik automobila smanjuje razred i da ga poveća, priprema novu dokumentaciju.

Opća baza podataka vozača dostupna je u svim osiguravajućim tvrtkama koje se bave izdavanjem Osago politika. Baza podataka je dovršena, oni također čine.

KBM, što je koeficijent i kao vozač znati svoj KBM, kako koristiti tablicu kako bi odredio KBM

Vozač ima podatke o vlastitom razredu. Međutim, sama klasa nije više od abecedne oznake koeficijenta CBM-a. Ovaj pokazatelj je jedina metoda smanjenja iznosa plaćanja osiguranja. Svi podaci koji se razmatraju u ovom članku o razredima razreda za najveći dio i KBM.

Prije toga, CBM je korišten samo za određeno vozilo, pa kada automobil proda dodatni trošak ili popust na osiguranje je nestao. U tom slučaju vozač je morao zaraditi nove bodove za dobivanje popusta. U 2008. godini sustav se promijenio, a od 2016. godine CBM je počeo dodijeliti ne automobil, već samog vozača. To znači da bez obzira na osiguravatelja ili automobil, KBM ostaje na vozaču jedan indikator.

Da biste provjerili CBM motorista RCA, potrebno je napraviti korake gore navedene korake, a zatim početi izračunati vlastitu stopu osiguranja na Osagu. Da biste saznali podatke o CBM-u na sljedećoj tablici u nastavku, morate znati samo svoj vlastiti razred, kao i broj plaćanja osiguranja za godinu.

Kada koristite tablicu, trebate biti vođeni takvim odredbama:

- Prilikom upisivanja primarnog osiguranja, vozač je dodijeljen treći razred.

- Broj osiguranih slučajeva određuje se kvar vozača za godinu osiguranja. Ako se potraživanja osiguranja ne dogodi, vozač prima povećanu klasu za sljedeću godinu. Ako postoji neka odšteta osiguranja, sljedeće godine vlasnik automobila će primiti "1" klasu, u slučaju dvije naknade - "m" klase i tako dalje.

- U nedostatku naknade za osiguranje i povećanju razred od trećeg (početnog) do četvrtog, koeficijent CBM-a će biti 0,95.

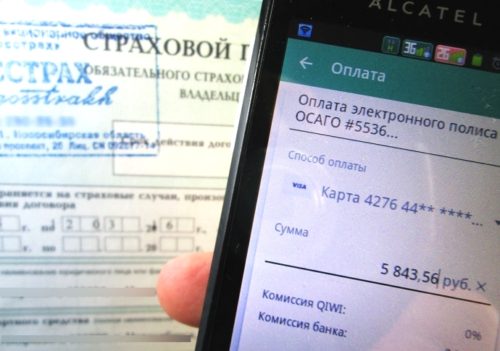

Osago 2017 politika, koja čeka vozača

Glavna promjena u politici Osago - od prvog siječnja 2017., osiguravajuća društva koje djeluju na tržištu Osago trebat će se prodavati elektroničke politike. U isto vrijeme, zahtjev za "osiguranje kontinuiteta i glatkoće funkcioniranja svojih mjesta" su dodani u osiguravajuća društva, a kada se pojave tehnički problemi, osiguravatelj mora odmah prijaviti središnjoj banci.

Vijeće Profi: kao disciplinirani upravljački program može akumulirati za 50% popusta

Na temelju gore navedenog, može se zaključiti da osiguranje OSAO pruža prilično fleksibilan kumulativni sustav za vozača, koji, s dobrom poviješću osiguranja, može doći do 50 posto. To znači da kada primate maksimalnu klasu, vlasnik automobila može obnoviti osiguranje dva puta jeftinije od standardnih troškova.

Povezani materijali

- Peć 2110, loš topli štednjak 2110, VZ 2110 Sustav grijanja, popravak sustava grijanja VAZ 2110 vlastitim rukama

- VAZ 2114 štednjak puše s hladnim zrakom, štednjak 2114, loš topli štednjak vaz 2114, uređaj i popravak grijanja VAZ 2114 do-it-yourself, uklanjanje štednjak VAZ 2114

- Kako subdominatizirati automobil. Kako staviti utičnicu. Vrste priključnica za automobile.

- VAZ 2109 Blok osigurača, VZ 2109 Blok osigurača, VZ 2109 Blok osigurača Blok, stari VAZ 2109 Blok osigurača, VAZ 2109 osigurač blok, vaz osigurač blok 2109

- Katalizator ispušnih plinova automobila, neispravan katalizator, pluse i mane katalizatora, kako promijeniti katalizator na ramencitel

- Štednjak puhanje hladnog zraka vaz 2114, loše puhanje štednjak vaz 2114, zašto loše puše štednjak vaz 2114

- Kako saznati vlasnik automobila po broju automobila, provjeriti automobil po broju prometnog policijskog stroja, provjeriti automobil od strane državnog broja automobila besplatno

- Kako odabrati rabljene gume, korisne savjete

- Zimski automobil, tlak u putničkim automobilima zimi, dobru bateriju za automobil zimi, hoće li zimi zagrijati automobil

- Zimi je automobil slabo pokrenut. Kako napraviti auto zimi, trebate li zagrijati automobil zimi, korisne savjete

- Strojevi za potrošnju goriva u gospodarstvu, najekonomičniju potrošnju automobila

- Gume brandova za osobna vozila, označavanje označavanja guma automobila, zaostalo putničkog automobila zaštitnika guma, kako odabrati gumu na marku automobila, uzorak gaznoga sloja automobila

- Rad prijenosa Rad, mehanički mjenjač kvačilo, vožnja s ručnim mjenjačem, korisnim savjetima

- Stražnji snop peugeot 206 limuzi, stražnji snop peugeot 206. Stražnji snop Peugeot 206 kvarovi, popravak stražnjeg snopa Peugeot 206

- Dizel gorivo zimi, aditiv za dizelsko gorivo zimi, kako odabrati najbolje dizelsko gorivo

- Dizel zima ne počinje. Kako započeti dizel zimi, grijanje dizel zimi.

- Japanci Bridgestone gume, zimska okovana Bridgestone gume, brand Bridgestone gume

- Označavanje guma Dekodiranje za osobne automobile, označavanje kotača, kako odabrati desne gume na diskovima

- Dizelski motor zimi, pokretanje dizelskog motora zimi, što ulje popunjava dizelski motor zimi, korisni savjeti

- LED pozadinsko osvjetljenje automobila, pozadinsko osvjetljenje dna automobila, pozadinsko osvjetljenje nogu u automobilu, pozadinsko osvjetljenje na vratima automobila, pozadinsko osvjetljenje automobila je u redu

- Oporavljene gume, guma autobusa, obnovljena zaštitnica guma, mogu li ih koristiti

- Odaberite zimske gume, koje su zimske gume, koje tlak u zimskim gumama trebaju biti označene zimskim gumama, kako odabrati prave zimske gume, najbolje zimske gume 2019

- Upravljač željeznicom, kucanje upravljačkog stalka, razlozi za kucanje i popravak raka upravljača to čine sami

- Gume za automobile bez grešaka, skup za popravak guma bezbojnih, popravak gume bez topova

- Ruske gume, ruske gume zime, ruske cijele sezonske gume, Voronezh Amtel gume, gume "Matador Omsk guma", Kama-gume su svjetski razred autobus

- Kako otvoriti automobil bez ključa. Izgubio je ključ od automobila što učiniti, ključ od automobila unutar automobila

- Tihe gume, mirne zimske gume, miran sabirni autobus, koje gume biraju, pregledavaju gume

- Gume i sigurnost, sigurnost autobusa, zašto je potrebno stalno pratiti auto gume

- Pravila sigurnog vožnje automobila u kiši i bljuzganju, sigurna vožnja automobila za početnike

- Converter za hrđu koji je bolji za automobile, RUST pretvarači da biraju kako koristiti transducer za hrđu, profesionalce

- Poliranje tijela automobila to učiniti sami, kako odabrati poliranje paste, korisne savjete

- Trajnost motora, život motora, kako produžiti život motora

- Kucati u auto. Knock prilikom premještanja automobila. Što može kucati u autu. Kako odrediti uzrok kucanja.

- ABS Car, što je ABS CAR, ABS sustav kvar, ABS dijagnostika

- Pretjecanje automobila kada možete početi pretjerivati \u200b\u200bautomobil, pravila prometnih pravila

- Pumpa za gorivo VAZ 2110, VZ 2110 Shema benzinske postaje, VZ 2110 uređaja za pumpe za gorivo, VAZ 2110 Popravak benzinske postaje,

- Automobilske antene za radio, automobilsku antenu, auto antene to učiniti sami

- Prednji suspenzija Kalina, prednja suspenzija uređaja Kalina, kucanje u prednjoj suspenziji Kalina, popravak prednjeg ovjesa Kalina

- Ulje za apsorpciju udara, najbolje apsorberi ulja za ulje, pumpanje ulja amortizeri, kako pravilno pumpati uljni amortizer

- Kvačilo kvačilo, dodiruje kvačilo, uzrokuje kvačilo kvačilo, kako eliminirati

Komentari