Saat ini, kebijakan Osago adalah wajib bagi setiap warga negara kendaraan milik negara kami. Saat membuat kebijakan ini untuk pemilik mobil yang memiliki data berkualitas sangat baik, diskon tertentu disediakan. Apa diskon ini dan bagaimana cara mendapatkannya - baca lebih lanjut dalam artikel.

Isi

- Biaya CTP, dari mana biaya CTP tergantung

- Kelas asuransi pengemudi, bagaimana pengaruhnya terhadap harga asuransi

- Kelas pengemudi, cara mengetahui kelas pengemudi di CTP

- KBM, apa koefisien dan sebagai pengemudi untuk mengetahui KBM-nya, bagaimana menggunakan tabel untuk menentukan KBM

- Kebijakan Osago 2017, yang sedang menunggu pengemudi

- Dewan Profi: Sebagai pengemudi yang disiplin dapat menumpuk dengan diskon 50%

Biaya CTP, dari mana biaya CTP tergantung

Elemen penting dalam asuransi asuransi adalah koefisien CBM (koefisien bonus-malyus) adalah indikator khusus yang mempengaruhi jumlah pembayaran. Dengan bantuan koefisien ini bahwa jumlah pembayaran asuransi untuk kebijakan yang didekorasi dapat dikurangi.

Kelas asuransi pengemudi, bagaimana pengaruhnya terhadap harga asuransi

Saat membuat asuransi, kelas pengemudi memainkan peran utama dalam menghasilkan biaya layanan. Perhitungan biaya dilakukan berdasarkan data tersebut:

- Tempat tinggal - di setiap wilayah ada statistik kecelakaan lalu lintas sendiri, oleh karena itu, koefisien ditentukan berdasarkan analisis statistik.

- Untuk setiap jenis transportasi, tarifnya ditetapkan - mobil penumpang, kendaraan angkutan, bus.

- Untuk setiap model dan merek, tarif khusus dikembangkan, mengingat frekuensi hutang mereka dalam kecelakaan.

- Untuk driver muda, koefisien yang lebih tinggi diinstal, untuk driver dewasa - lebih rendah. Juga dalam kategori ini, Anda dapat menambahkan pengalaman driver yang tidak jarang tergantung pada usia pemilik mobil.

- Sejarah Mengemudi - Tergantung pada indikator ini, layanan asuransi menentukan kelas pengemudi dan menghitung CBM.

Kelas pengemudi, cara mengetahui kelas pengemudi di CTP

Menurut sistem CTP, ada kelas-kelas seperti itu - "0", "M", "1", "2" dan seterusnya ke "13". Jika riwayat asuransi pengemudi hilang, koefisien "1" diinstal secara otomatis. Ini berarti bahwa ketika menghitung harga, semua faktor yang tercantum di atas diperhitungkan, selain yang kelima. Setiap tahun drive bebas masalah akan mengambil kelas yang lebih tinggi.

Untuk mengetahui kelas pengemudi, Anda harus membiasakan diri dengan data yang disajikan di situs web Uni Rusia dari jalan raya dan pada sumber informasi lain yang memberikan kesempatan seperti itu. Untuk memeriksa, Anda harus memasukkan informasi tersebut dalam database - nomor SIM, tanggal lahir dan nama. Setelah memasukkan informasi, semua data yang berkaitan dengan riwayat asuransi dari driver tertentu akan tersedia. Dengan demikian, adalah mungkin untuk mendapatkan informasi yang Anda inginkan terlepas dari perusahaan yang menyediakan layanan atau tanggal pendaftaran asuransi.

Sistem ini bermanfaat dan driver, dan perusahaan asuransi. Pengemudi dapat memperoleh data yang relevan bahkan selama meneringi asuransi, dan dengan desain baru CTP, data tetap dari asuransi sebelumnya. Adapun perusahaan asuransi, mereka dapat memeriksa data pada pengemudi bahkan jika mengubah perusahaan dan kesimpulan dari asuransi baru, yang mencegah kemungkinan penipuan ketika pemilik mobil mengurangi kelas dan untuk meningkatkannya, sebuah dokumentasi baru sedang mempersiapkan.

Database umum driver tersedia di semua perusahaan asuransi yang terlibat dalam penerbitan kebijakan Osago. Basis data selesai, mereka juga melakukannya.

KBM, apa koefisien dan sebagai pengemudi untuk mengetahui KBM-nya, bagaimana menggunakan tabel untuk menentukan KBM

Pengemudi memiliki data di kelasnya sendiri. Namun, kelas itu sendiri tidak lebih dari penunjukan alfabet dari koefisien CBM. Indikator ini adalah satu-satunya metode untuk mengurangi jumlah pembayaran asuransi. Semua data dipertimbangkan dalam artikel ini di kelas kelas untuk sebagian besar dan KBM.

Sebelumnya, CBM hanya digunakan untuk kendaraan tertentu, jadi ketika mobil menjual biaya tambahan atau diskon untuk asuransi menghilang. Dalam hal ini, pengemudi harus mendapatkan poin baru untuk mendapatkan diskon. Pada 2008, sistem telah berubah, dan sejak 2016, CBM mulai menetapkan bukan mobil, tetapi pengemudi itu sendiri. Ini berarti bahwa terlepas dari perusahaan asuransi atau mobil, KBM tetap di pengemudi satu indikator.

Untuk memeriksa CBM pengendara RCA, langkah-langkah yang dijelaskan di atas harus dilakukan, maka mulailah menghitung tingkat asuransi mereka sendiri di Osago. Untuk mengetahui data pada CBM pada tabel berikut di bawah ini, Anda hanya perlu mengenal kelas Anda sendiri, serta jumlah pembayaran asuransi untuk tahun ini.

Saat menggunakan tabel, Anda harus dipandu oleh ketentuan tersebut:

- Saat mengetik asuransi primer, pengemudi ditugaskan kelas tiga.

- Jumlah kasus yang diasuransikan ditentukan oleh kesalahan pengemudi untuk tahun asuransi. Jika klaim asuransi tidak terjadi, pengemudi menerima kelas yang meningkat untuk tahun berikutnya. Jika ada satu asuransi ganti rugi, tahun berikutnya pemilik mobil akan menerima kelas "1", dalam kasus dua kompensasi - kelas "M" dan sebagainya.

- Dengan tidak adanya kompensasi asuransi dan peningkatan kelas dari ketiga (awal) ke keempat, koefisien CBM akan menjadi 0,95.

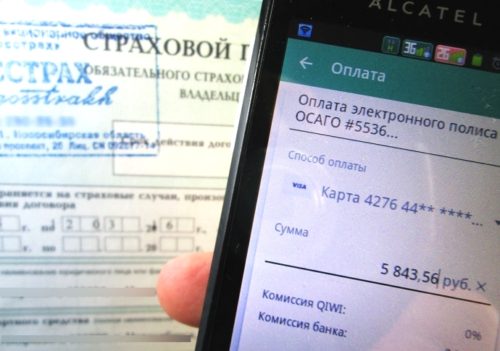

Kebijakan Osago 2017, yang sedang menunggu pengemudi

Perubahan utama dalam kebijakan Osago - sejak Januari 2017, perusahaan asuransi yang beroperasi di pasar Osago akan diminta untuk menjual kebijakan elektronik. Pada saat yang sama, persyaratan untuk "memastikan kesinambungan dan kehalusan fungsi situs mereka" telah ditambahkan ke perusahaan asuransi, dan ketika masalah teknis muncul, perusahaan asuransi harus segera melaporkannya ke bank sentral.

Dewan Profi: Sebagai pengemudi yang disiplin dapat menumpuk dengan diskon 50%

Berdasarkan hal tersebut di atas, dapat disimpulkan bahwa asuransi OSAO menyediakan sistem kumulatif yang cukup fleksibel untuk pengemudi, yang, dengan sejarah asuransi yang baik, mampu mencapai 50 persen. Ini berarti bahwa ketika menerima kelas maksimum, pemilik mobil dapat mengisi kembali asuransi dua kali lebih murah daripada biaya standarnya.

Bahan terkait

- Kompor 2110, Kompor Hangat Buruk 2110, VAZ 2110 Sistem Pemanas, Memperbaiki Sistem Pemanas VAZ 2110 dengan tangan mereka sendiri

- VAZ 2114 kompor pukulan dengan udara dingin, kompor 2114, kompor hangat buruk VAZ 2114, perangkat dan perbaikan pemanasan vaz 2114 do-it-yourself, menghapus kompor vaz 2114

- Cara subdominize mobil. Cara meletakkan jack. Jenis jack untuk mobil.

- VAZ 2109 Blok Sekering, VAZ 2109 Fuse Block Carburetor, VAZ 2109 Fuse Block Injector, Blok Sekering VAZ 2109, VAZ 2109 Fuse Block, VAZ Fuse Block 2109

- Katalis gas buang mobil, katalis yang rusak, plus dan kontra dari katalis, cara mengubah katalis di pesawat

- Kompor meniup udara dingin VAZ 2114, dengan buruk meniup kompor VAZ 2114, mengapa dengan buruk meniup kompor VAZ 2114

- Cara mencari tahu pemilik mobil dengan jumlah mobilnya, periksa mobil dengan jumlah mesin polisi lalu lintas, periksa mobil dengan jumlah negara mobil secara gratis

- Cara Memilih Ban Digunakan, Tips Berguna

- Jalan mobil musim dingin, tekanan dalam ban mobil penumpang di musim dingin, baterai yang baik untuk mobil di musim dingin, apakah akan menghangatkan mobil di musim dingin

- Di musim dingin, mobil ini dimulai dengan buruk. Cara membuat mobil di musim dingin, apakah Anda perlu menghangatkan mobil di musim dingin, tips berguna

- Mesin konsumsi bahan bakar ekonomi, konsumsi mobil paling ekonomis

- Merek Ban untuk Mobil Penumpang, Pelabelan Label Ban Mobil, Pelindung Ban Mobil Penumpang Residual, Cara Memilih Ban Pada Merek Mobil, Pola Tapak Ban Mobil

- Operasi transmisi yang berfungsi, pekerjaan gearbox gearbox, mengemudi dengan gearbox manual, tips berguna

- Balok belakang peugeot 206 sedan, perangkat balok belakang Peugeot 206. Balok belakang peugeot 206 kerusakan, perbaikan balok belakang peugeot 206

- Bahan bakar diesel di musim dingin, aditif untuk bahan bakar diesel di musim dingin, bagaimana memilih bahan bakar diesel terbaik

- Diesel musim dingin tidak dimulai. Cara memulai diesel di musim dingin, pemanas diesel di musim dingin.

- Ban Bridgestone Jepang, Ban Bridgestone bertabur musim dingin, Merek Ban Bridgestone

- Penandaan ban decoding untuk mobil penumpang, roda pelabelan, bagaimana memilih ban yang tepat pada disk

- Mesin diesel di musim dingin, peluncuran mesin diesel di musim dingin, minyak apa yang akan mengisi mesin diesel di musim dingin, tips berguna

- LED backlight dari mobil, lampu latar dari bagian bawah mobil, lampu latar kaki di dalam mobil, lampu latar di pintu mobil, lampu latar mobil baik-baik saja

- Ban yang dipulihkan, ban bus, pelindung ban yang dipulihkan, dapatkah saya menggunakannya

- Pilih Ban Musim Dingin, yang merupakan ban musim dingin, yang tekanan pada ban musim dingin harus ditandai dengan ban musim dingin, bagaimana memilih ban musim dingin yang tepat, ban musim dingin terbaik 2019

- Rel rel kemudi, ketukan rak kemudi, alasan knock dan perbaikan rak kemudi melakukannya sendiri

- Ban mobil tanpa roti, satu set untuk perbaikan ban tubeless, perbaikan ban bebas meriam melakukannya sendiri

- Ban Rusia, Ban Rusia Musim Dingin, Ban All-Seas Rusia, Voronezh Amtel Ban, Ban "Ban Matador Omsk", Ban Kama adalah bus kelas dunia

- Cara membuka mobil tanpa kunci. Kehilangan kunci dari mobil apa yang harus dilakukan, kunci dari mobil di dalam mobil

- Ban hening, ban musim dingin yang tenang, bus bertabur yang tenang, yang ban untuk memilih, ikhtisar ban

- Ban dan keamanan, keamanan bus, mengapa perlu untuk terus memantau ban mobil

- Aturan mengemudi mobil yang aman di tengah hujan dan lumpur, mengemudi mobil yang aman untuk pemula

- Konverter karat yang lebih baik untuk mobil, konverter karat untuk memilih cara menggunakan transduser karat, profesional

- Memoles tubuh mobil melakukannya sendiri, bagaimana memilih pasta pemoles, tips bermanfaat

- Daya tahan engine, kehidupan engine, cara memperpanjang kehidupan mesin

- Ketuk mobil. Ketukan saat menggerakkan mobil. Apa yang bisa mengetuk mobil. Cara menentukan penyebab ketukan.

- Mobil ABS, apa itu mobil ABS, kerusakan sistem abs, diagnostik ABS

- Menyalip mobil ketika Anda dapat mulai menyalip mobil, aturan aturan lalu lintas

- Pompa Bahan Bakar VAZ 2110, VAZ 2110 Skema Pompa Gas, VAZ 2110 Perangkat Pompa Bahan Bakar, VAZ 2110 Perbaikan pompa bensin,

- Antena otomotif untuk radio, perangkat antena otomotif, antena mobil melakukannya sendiri

- Suspensi depan Kalina, suspensi depan perangkat Kalina, ketuk suspensi depan Kalina, perbaikan suspensi depan Kalina

- Minyak peredam kejut, peredam kejut minyak terbaik, pemompa peredam kejut minyak, cara memompa peredam kejut minyak dengan benar

- Kerusakan kopling, menyentuh kopling, menyebabkan kerusakan kopling, cara menghilangkan

Komentar